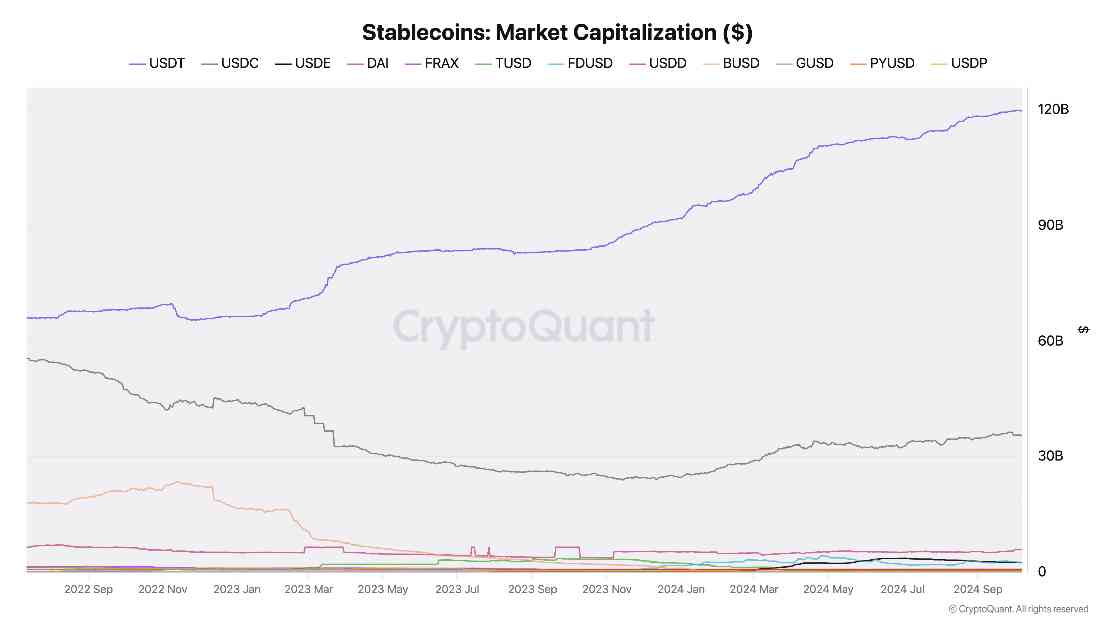

Tether, one of the leading stablecoins in the crypto market, has been driving a surge in liquidity as stablecoins collectively reach a total of $169 billion in market capitalization. This represents a significant 31% increase year-to-date, indicating a growing trend in the use of stablecoins.

Specifically, Tether’s USDT balances on centralized exchanges have seen a substantial growth, rising to $22.7 billion in October. This marks a 54% increase of $8 billion since the beginning of the year. Additionally, centralized exchanges hold around $8.5 billion of USDT issued on the TRON network, further contributing to the overall liquidity surge in the market.

The rise in stablecoin balances has shown a positive correlation with higher Bitcoin and crypto prices, highlighting the impact of stablecoins on the broader market. Despite Bitcoin’s price remaining relatively flat, the 20% growth in USDT balances since August has indicated increased liquidity and potential market movement.

In addition to Tether, Ripple has entered the stablecoin market with the introduction of RLUSD, a US dollar-backed stablecoin operating on both the XRP Ledger and Ethereum networks. With a market capitalization of $47 million, Ripple’s entry into the stablecoin space signifies the company’s expansion into the remittance and money transfer market.

The influx of stablecoins like USDT and the emergence of new players such as RLUSD from Ripple suggest potential shifts in the crypto market landscape. As liquidity continues to increase and new stablecoins enter the market, investors and traders may see new opportunities and dynamics unfold in the coming months.