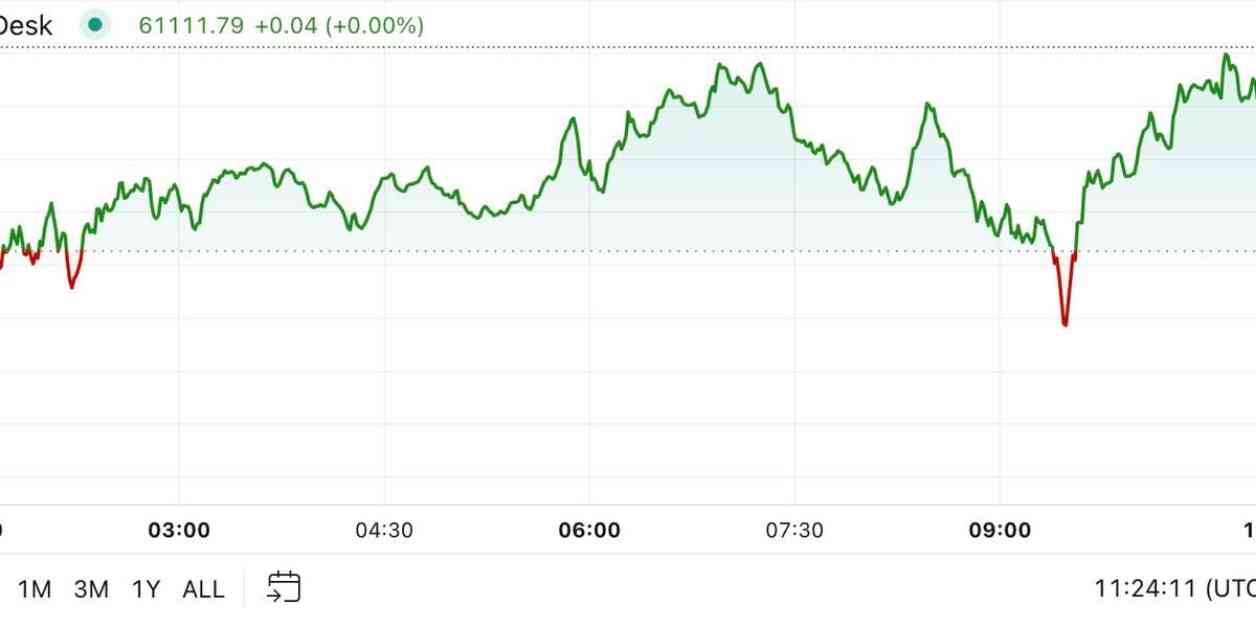

Bitcoin’s price in the Americas surged to $61,000 before the September CPI report. Despite a slight dip to $60,300, Bitcoin recovered to $61,000, trading about 1.6% lower over 24 hours. The broader crypto market, as measured by the CoinDesk 20 Index, fell by 2%. Investors are now turning their attention to the September CPI report from the U.S., which is expected to show slight increases month-on-month and year-on-year. Any hotter-than-expected prints could lead to calls to halt interest-rate cuts, potentially impacting risk assets like cryptocurrencies.

The recent release of the minutes from the September Fed meeting revealed a divide among policymakers on the aggressiveness of interest rate cuts. While a majority of participants favored a half-percentage point cut, some expressed concerns about the size of the cut. This uncertainty has contributed to a shift in crypto sentiment, moving it back into the fear zone.

The strengthening of the dollar and the increased attractiveness of bonds have reduced institutional interest in Bitcoin, contributing to the recent market dynamics. The dollar index rose to its highest level since August, indicating a cumulative gain of 2.7% since its recent low in September.

In the U.S., Ether ETFs experienced zero flows in either direction on Wednesday, marking the second time this week and the third time since their listing in July. In contrast, Bitcoin ETFs saw outflows of over $30.5 million on the same day. Despite the muted activity in ETFs, Bitcoin equivalents have drawn net inflows of nearly $19 billion since January.

Looking at the options market, Bitcoin’s seven-day skew has slipped to -8.5%, the lowest in four weeks. This negative skew suggests a bias for protective put options, reflecting concerns about potential downside price risks in the near future.

As the cryptocurrency market continues to evolve, investors are closely monitoring key economic indicators and policy decisions that could impact the prices of digital assets. The shifting sentiment, coupled with market dynamics and regulatory developments, are shaping the future trajectory of Bitcoin and other cryptocurrencies.

Overall, the recent price movements reflect the ongoing volatility and uncertainty in the crypto market, influenced by a combination of economic data, policy decisions, and investor sentiment. It remains to be seen how these factors will continue to shape the market in the coming days and weeks.