Why Bitcoin ETFs Fail to Attract Traditional Finance or Boomer Investors: Insights from Jim Bianco

The world of cryptocurrencies has seen significant growth in recent years, with Bitcoin leading the charge as the most popular and widely recognized digital asset. As the market for Bitcoin continues to evolve, the introduction of Bitcoin Exchange-Traded Funds (ETFs) was expected to open up new avenues for investment, particularly among traditional finance (TradFi) investors and older generations, often referred to as “boomers.” However, according to macro expert Jim Bianco, Bitcoin ETFs have failed to attract the interest of these demographic groups, with several key factors contributing to this lackluster adoption.

One of the primary reasons cited by Bianco for the underwhelming performance of Bitcoin ETFs among traditional finance investors is the lack of engagement from investment advisors. In a market where financial advice and guidance play a crucial role in shaping investment decisions, the absence of support and endorsement from investment professionals has hindered the mainstream adoption of Bitcoin ETFs. Bianco points out that a staggering 85% of Bitcoin ETF activity is not coming from traditional financial institutions, highlighting a significant gap in institutional involvement compared to other traditional asset classes.

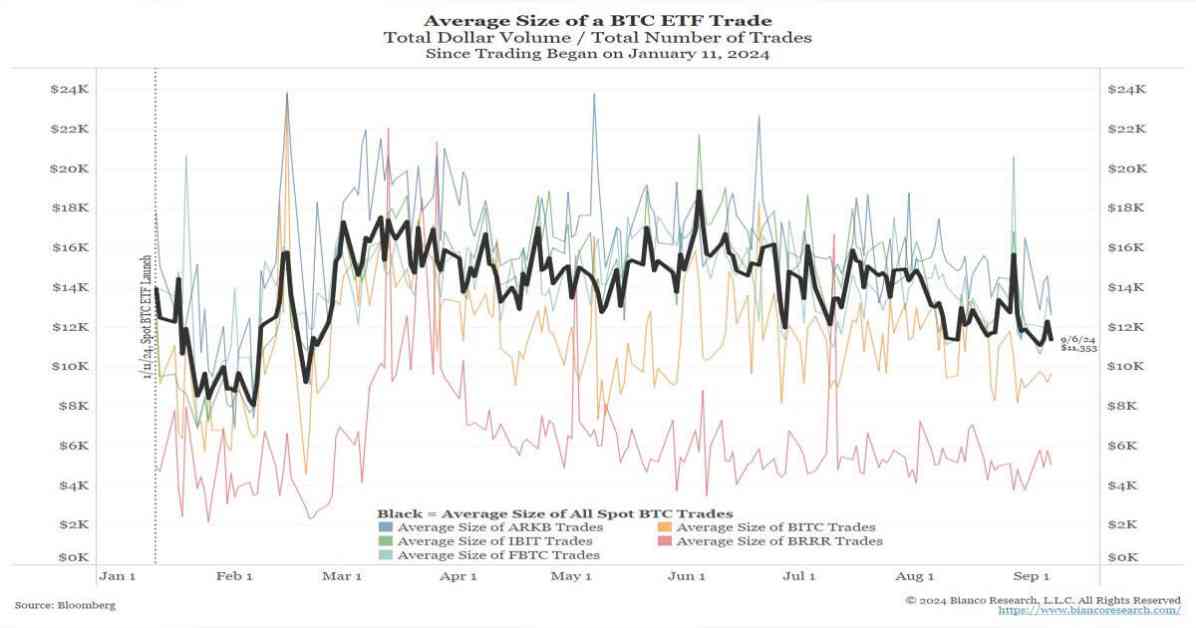

Furthermore, Bianco highlights the predominance of retail activity in the Bitcoin ETF market as a key factor driving the lack of interest from traditional finance investors. The average trade size for Bitcoin ETFs has plummeted to below $12,000, the lowest level since March 2024, indicating that smaller retail investors are the primary participants in this market. This stands in stark contrast to more established ETFs like SPY and QQQ, which typically attract larger institutional players. The shift towards smaller retail investors suggests that Bitcoin ETFs have yet to gain the trust and confidence of traditional finance investors who prefer to engage with more conventional investment vehicles.

In addition to the lack of institutional involvement and retail dominance, Bianco points out the significant unrealized losses faced by Bitcoin ETF holders as another deterrent for traditional finance investors. With the average purchase price for Bitcoin ETFs standing at $61,000, based on recent market data, holders are currently facing a substantial $2.2 billion in unrealized losses. This stark contrast between the purchase price and the current market value of Bitcoin ETFs has raised concerns among investors, particularly those from traditional finance backgrounds who prioritize stability and security in their investment portfolios.

Despite the challenges and barriers hindering the adoption of Bitcoin ETFs among traditional finance investors, Bianco remains optimistic about the future potential of these digital assets. He believes that as the market matures and regulatory frameworks become more robust, traditional finance institutions and older generations will gradually warm up to the idea of including Bitcoin ETFs in their investment portfolios. However, until significant changes are made to address the current limitations and concerns surrounding Bitcoin ETFs, it is unlikely that traditional finance and boomer investors will fully embrace this emerging asset class.

The Future of Bitcoin ETFs: Overcoming Barriers to Mainstream Adoption

As the cryptocurrency market continues to evolve and expand, the potential for Bitcoin ETFs to attract a wider range of investors, including traditional finance institutions and older generations, remains a topic of keen interest. While the current landscape presents several challenges and barriers to mainstream adoption, there are opportunities for growth and development that could propel Bitcoin ETFs into the spotlight as a viable investment option for a broader audience.

One key area that could drive increased interest and participation in Bitcoin ETFs is the development of robust regulatory frameworks that provide clarity and transparency for investors. Regulatory uncertainty has been a significant deterrent for traditional finance institutions and older investors looking to enter the cryptocurrency market, as concerns about compliance and legal risks continue to loom large. By establishing clear guidelines and regulations governing the operation of Bitcoin ETFs, regulators can instill confidence and trust in potential investors, paving the way for greater adoption and acceptance of these digital assets.

Moreover, education and awareness initiatives can play a crucial role in bridging the gap between traditional finance investors and Bitcoin ETFs. As the cryptocurrency market remains relatively new and unfamiliar to many investors, providing comprehensive information and resources on the potential benefits and risks of investing in Bitcoin ETFs can help demystify the asset class and encourage more informed decision-making. By equipping investors with the knowledge and tools they need to navigate the complexities of the cryptocurrency market, traditional finance institutions and older generations can feel more confident in exploring the opportunities presented by Bitcoin ETFs.

Another important factor that could drive mainstream adoption of Bitcoin ETFs is the development of innovative investment products that cater to the specific needs and preferences of traditional finance investors. By introducing new features and functionalities that align with the investment strategies and risk profiles of this demographic group, Bitcoin ETF providers can attract a broader base of investors and diversify their investor base. Additionally, offering enhanced security measures and risk management protocols can address the concerns of traditional finance institutions and older investors who prioritize stability and protection of their assets.

In conclusion, while Bitcoin ETFs have yet to gain significant traction among traditional finance investors and boomer generations, there are opportunities for growth and expansion that could position these digital assets as a mainstream investment option in the future. By addressing the current barriers and challenges hindering adoption, such as regulatory uncertainty, lack of institutional involvement, and unrealized losses, Bitcoin ETF providers can pave the way for a more inclusive and diverse investor base. With a concerted effort to enhance education, awareness, and product innovation, Bitcoin ETFs have the potential to revolutionize the traditional finance landscape and attract a new wave of investors seeking exposure to the dynamic world of cryptocurrencies.