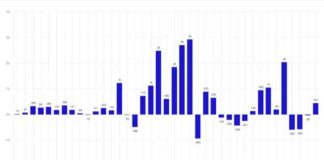

Bank of America strategists have estimated that it requires in-flows of only $93 million to maneuver Bitcoin’s cost by just one percent.

The currently notorious Bank of America study notice slamming Bitcoin also comprises research indicating that it requires only $93 million worth of inflows to maneuver Bitcoin’s cost by 1 percent.

The study found that it might require at least two billion worth of inflows to maneuver the purchase price of gold with one percentile, whereas more than $2.25 billion will be necessary to apply the exact same cost effect on 20-year-plus treasury stocks.

“We quote a net inflow in to Bitcoin of only $93 million will Lead to cost appreciation of 1 percent,” the report concluded, including:

“What’s generated the monumental upside strain on Bitcoin costs in the past few years and, especially, in 2020? The easy response: little capital inflows.”

With Bitcoin’s almost $1.1 trillion market cap equating to about 10 percent of gold, the study indicates Bitcoin is twice as volatile as golden per-dollar in-flows regardless of the asset present for almost a dozen years.

The Bank of America researchers attribute the little cost required to move the purchase price of Bitcoin to significant accumulation from whales decreasing the amount of coins available to sale on exchanges. “Looking at comprehensive blockchain documents, we discover the biggest addresses have yet to be selling in aggregate because the pandemic began,” they said.

Bank of America’s assertions seem broadly based on findings from crypto analytics company Glassnode, which estimated 78 percent of Bitcoin’s distribution was illiquid at December 2020, leaving only 20 percent of circulating supply available for trade exchanges.

Before this month, Glassnode estimated that 95 percent of BTC traded past transferred on-chain in the previous few weeks , further evidencing which whales are stashing their coins to the long run.

Regardless of Bank of America’s discovering seeming to encourage Glassnode’s BTC bull-case, the report required a highly damaging tone regarding Bitcoin entire — slamming the crypto advantage for becoming volatile, polluting, and an”impractical” way of payment.