The recent proposal by the Biden administration to impose a 30% tax on cryptocurrency miners has sparked concerns and backlash within the industry. Many believe that this move represents an ideological attack on a rapidly growing sector and could have detrimental effects on the U.S. economy as a whole.

The tax, part of the government’s budget proposal for the upcoming fiscal year, aims to address environmental concerns related to cryptocurrency mining. However, critics argue that the tax is unjustified and could potentially violate constitutional clauses. They believe that such a tax could lead to job losses, reduced economic activity, and hinder innovation within the industry.

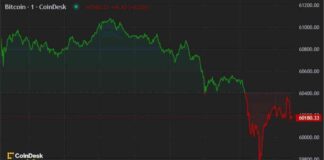

Moreover, the proposed tax could put the United States at a disadvantage in the global competition for dominance in the bitcoin mining sector. Countries like China, Russia, and Canada are already vying for a leading position, and the implementation of this tax could drive mining operations away from the U.S. to more favorable jurisdictions.

It is essential to consider the broader implications of such a tax on the cryptocurrency industry as a whole. By targeting bitcoin mining, the Biden administration may inadvertently discourage innovation and investment in the sector, which could have far-reaching consequences on the country’s technological development and competitiveness.

In conclusion, the proposed tax on bitcoin mining by the Biden administration could have severe negative impacts on the industry and the U.S. economy. It is crucial to carefully evaluate the implications of such a tax before implementing it to avoid unintended consequences and harm to the country’s economic growth and competitiveness.