Willy Woo says that the supply shock is not being noticed, much like Q4 2020, before Bitcoin’s price soared.

New data about the possibility of a bullish breakout is emerging as Bitcoin ( BTC ) trades sideways within the $30,000-$40,000 area.

Are Bitcoin’s investors preparing for a breakout similar to Q4 2020?

Willy Woo is an on-chain analyst. He anticipates a possible supply shock in Bitcoin’s market. Long-term holders continue to rake BTC supply from the short-term. Woo indicated in his Friday newsletter, that this process could push more Bitcoin out into circulation.

Analyst referred to the ratio between Bitcoin held by strong and weak hands, also known as Bitcoin Supply Ratio. He noted that the former is actively taking in selling pressurefrom whales who have been dumpling their crypto holdings from February.

Woo wrote, “It reminds of the supply shock which went unnoticed in the market in Q4 2020.” “Pundits were debating if BTC was an inflation-hedging tool in a post COVID world, when data was showing that long term investors were stacking BTC at an accelerated pace,” Woo said.

“The price then went on a tear and very quickly decoupled from its tight correlation to stocks.”

Rising number of active users

Another on-chain data analytics platform, Glassnode has also helped Bitcoin’s adoption prospects. According to the portal, 32,000 users are being added daily on average by Bitcoin’s network. This is a record for 2021.

In January 2018, the Bitcoin Network User Growth metric reached approximately 40,000. Prices have since corrected lower. It revealed that Bitcoin Network users have stopped visiting the network since its price dropped from $20,000 in January 2018 to $3,200 in December 2020.

Woo explained that “this is not the structure we’re experiencing right now.” Woo explained that new users are buying the dip at the highest rate since 2021.

“Again, another example illustrating divergence in the price action using on-chain data.”

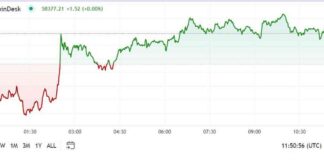

Bitcoin currently stands at $34,000 as of publishing time, an increase of 17.52% over its June 22 bottom point of $28,800.

Petr Kozyakov is the co-founder and CEO at Mercuryo, a crypto-enabled payment network. He believes Ether (ETH), may take the spotlight away from Bitcoin in the short term as the London hardfork approaches.

He said that the launch of the London Hard Fork upgrade, and the eventual migration to Ethereum 2.0 was helping to restore investors’ faith. Bitcoin could rise to $50,000 once the hype settles.”

Bitcoin withdrawals hit a one-year high

CryptoQuant , a data analytics company, reported Tuesday that Bitcoin’s net transaction count from spot-exchanges had crossed the 60,000 mark for the first year. The total number of Bitcoin deposits to spot-exchanges’ wallets fell to below 20,000.

In the same period, regulators increased their scrutiny of cryptocurrency trading platforms. The BTC withdrawal rate increased. The United Kingdom Financial Conduct Authority (FCA), for instance, has banned binance — the largest cryptocurrency exchange in volume — from engaging in regulated activity within the country “without prior written consent.”

Barclays informed its clients on Monday that they couldn’t transfer funds to Binance due to the FCA order. The London-based bank stated that clients can withdraw funds from Binance to their banks accounts.

The People’s Bank of China also reacted earlier Tuesday against a local business that was allegedly trading cryptocurrency alongside their regular business activities. Beijing had in effect banned all cryptocurrency-related activities in May. This effectively forced the largest crypto mining community in its region to shut down or relocate.

A rise in Bitcoin withdrawal rates can be interpreted as traders wanting to hold the cryptocurrency rather than trading it for fiat money or rival cryptocurrencies. With overall BTC withdrawals at a record high of 1 year, Bitcoin expects a higher level as it prepares for another upturn on the ” hodling”.