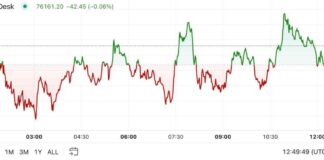

Bitcoin funding rates are on the rise, indicating a bullish and leveraged market. This surge in funding rates suggests that traders are increasingly interested in longing Bitcoin, which could potentially drive the price higher in the near future.

Bitcoin funding rates are a key indicator used by traders to gauge market sentiment. When funding rates are positive, it means that long traders are paying short traders, and vice versa. High funding rates typically indicate that the market is overheated and could be due for a correction.

In recent days, Bitcoin funding rates have been climbing steadily, reaching levels not seen since earlier this year. This uptick in funding rates suggests that traders are becoming more confident in the long-term prospects of Bitcoin, despite the recent price volatility.

It’s important to note that high funding rates can also make the market more susceptible to liquidations. When funding rates are high, leveraged traders are more likely to be liquidated if the market moves against them. This can lead to cascading liquidations and exacerbate price movements in either direction.

Overall, the increase in Bitcoin funding rates is a positive sign for the market, as it indicates growing confidence among traders. However, investors should remain cautious and be aware of the risks associated with trading on leverage in a volatile market like Bitcoin.

As always, it’s important to do your own research and consult with a financial advisor before making any investment decisions. Bitcoin is a highly volatile asset, and trading on leverage can magnify both gains and losses. Stay informed, stay safe, and happy trading!