Bitcoin futures open interest on the CME exchange has reached a record high of 218,000 BTC, equivalent to $21.3 billion. This surge in open interest indicates a bullish sentiment in the market, especially with the cryptocurrency’s market cap closing in on a historic $2 trillion milestone.

According to K33 research, the growth in CME open interest is mainly driven by active and direct market participants. This group is actively engaging with the futures market, contributing to the ongoing rally in Bitcoin prices. The recent introduction of options tied to U.S. spot ETFs is expected to further boost CME futures growth.

The increasing integration of Bitcoin into the traditional financial system is likely to lead to a decrease in volatility over time. Glassnode data shows that realized volatility has already decreased significantly, from over 100% to around 40%. Cash-margin contracts, which use stablecoins or U.S. dollars as collateral, are also at an all-time high on the CME, adding to the stability of the market.

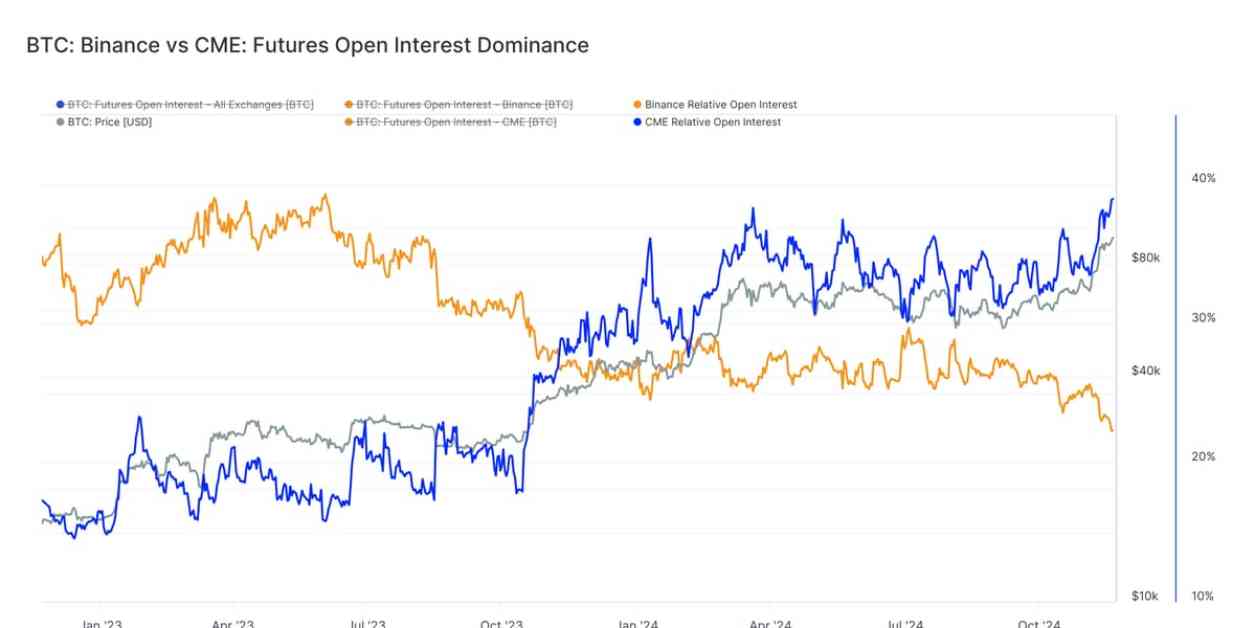

Furthermore, the dominance of cash margin contracts on the CME, as opposed to crypto margin contracts on retail-focused exchanges like Binance, is contributing to a more stable Bitcoin price. The percentage of futures contracts margined in crypto is at an all-time low, indicating a potential reduction in volatility moving forward.

With Bitcoin’s market cap inching closer to $2 trillion and the strong performance of CME futures, investors are closely watching the cryptocurrency’s price movements. The recent surge in Bitcoin prices, crossing $97,000 for the first time, has raised expectations of Bitcoin reaching $100,000 in the near future.

Overall, the outlook for Bitcoin remains positive, with growing institutional interest and improving market dynamics contributing to a more stable and mature cryptocurrency ecosystem. As Bitcoin continues to gain mainstream acceptance, its role in the financial markets is expected to expand, leading to further growth and adoption in the long term.