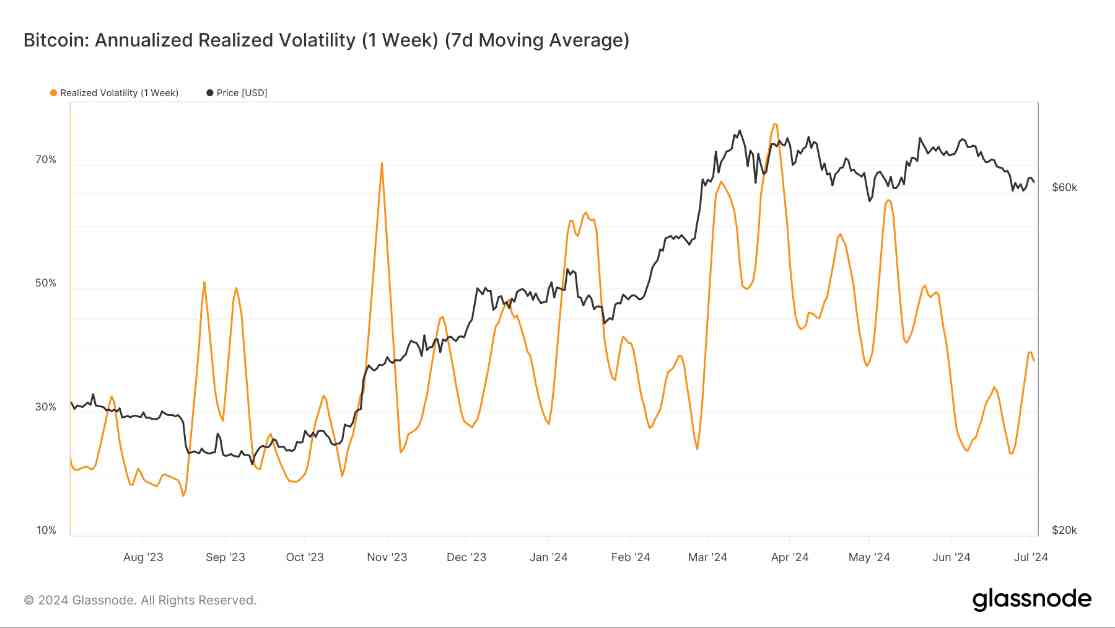

Bitcoin’s market maturity is being demonstrated by the recent low volatility and steady prices. The annualized realized volatility of Bitcoin has been fluctuating throughout 2024, showing significant market movements and reactions. Realized volatility is a measure of the standard deviation of returns from the mean return of a market, indicating the level of risk in that market.

In early 2024, Bitcoin’s volatility peaked at over 70% as the price approached $73,000. However, as the price corrected, the realized volatility saw a significant decline, bottoming near 20% by late June. Despite this, Bitcoin has maintained its value around $60,000, showing a pattern of relative calm in the market.

Historical data has shown that Bitcoin’s volatility often spikes during price surges or sharp declines. The long-term chart highlights volatility peaks corresponding with major price movements over the past decade. This volatility has remained a critical factor for traders and investors in the cryptocurrency market.

The current lower volatility phase of Bitcoin may indicate a market maturation or a temporary pause in market activity. However, past trends suggest that periods of low volatility are often followed by significant price movements, keeping market participants on high alert for potential shifts in the market.

Overall, the recent stability in Bitcoin’s prices and low volatility levels suggest a potential maturation of the market. However, it is important for investors and traders to remain vigilant and prepared for any potential shifts in the market dynamics in the future.