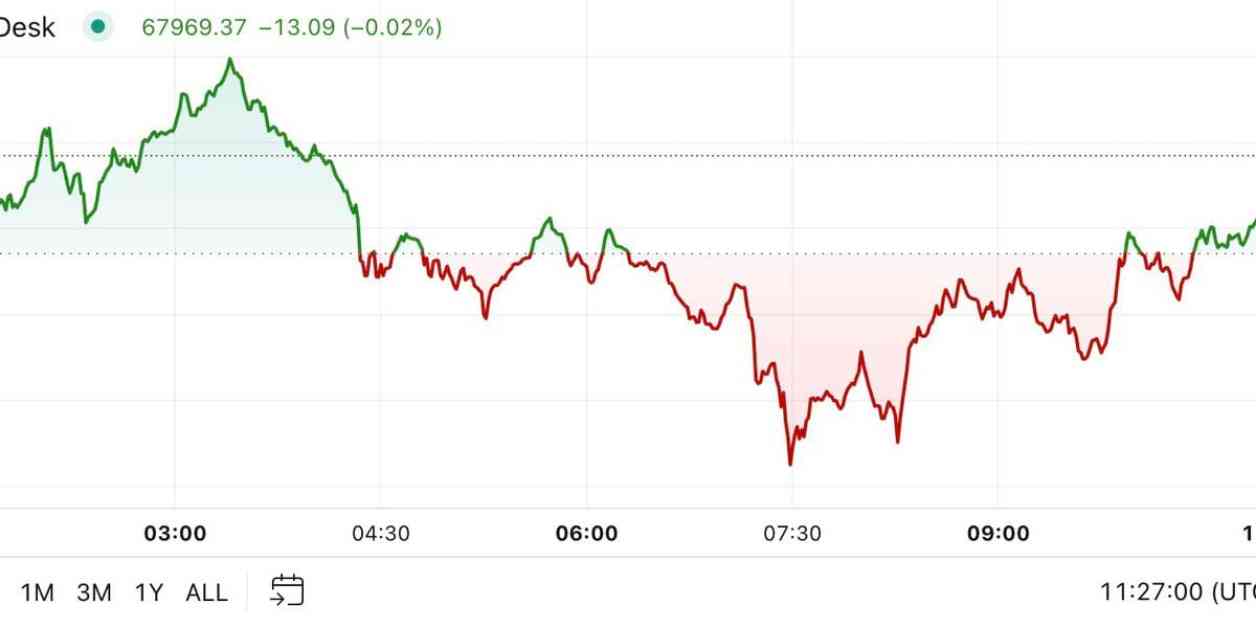

Bitcoin’s price dropped below $68,000, causing some concern in the market. Despite this drop, Bitcoin remains over 1.2% higher in the last 24 hours, outperforming other major tokens. Ethereum and SOL have seen modest gains, while DOGE is up nearly 1%. The broader digital asset market, as measured by the CoinDesk 20 Index, has risen just under 0.8%. However, Bitcoin seems to be on track to close the week over 1% lower, failing to sustain its previous highs above $68,000.

In other news, the board of Microsoft has advised shareholders to vote against a proposal to assess Bitcoin as an inflationary hedge. The company cited concerns about volatility and the need for stable and predictable investments for corporate treasury applications. Microsoft believes it has strong processes in place to manage and diversify its corporate treasury effectively.

Balance, a crypto custodian in Canada, has recently attained qualified custodian status. This development has prompted the company’s CEO, George Bordianu, to advocate for bringing the country’s ETF digital assets back home. Currently, crypto assets underlying funds issued by ETF providers in Canada end up in sub-custody arrangements held by U.S. exchanges like Coinbase and Gemini. Bordianu aims to simplify the process and make it more cost-effective for asset managers to keep these assets in Canada.

Looking at the chart of the day, bitcoin’s options-based implied volatility and forward implied volatility indicate expectations of price turbulence in the coming months. The higher forward IV for the Nov. 8 expiry suggests potential price swings, possibly related to the U.S. election result. Traders anticipate a price swing of around 3.8% on that day, reflecting the current market sentiment.

Overall, despite the fluctuations in Bitcoin’s price and the concerns raised by Microsoft, the cryptocurrency market continues to show resilience and potential for growth. Investors and stakeholders are closely monitoring these developments to make informed decisions in this dynamic market environment. Stay tuned for more updates on the crypto market and related news.