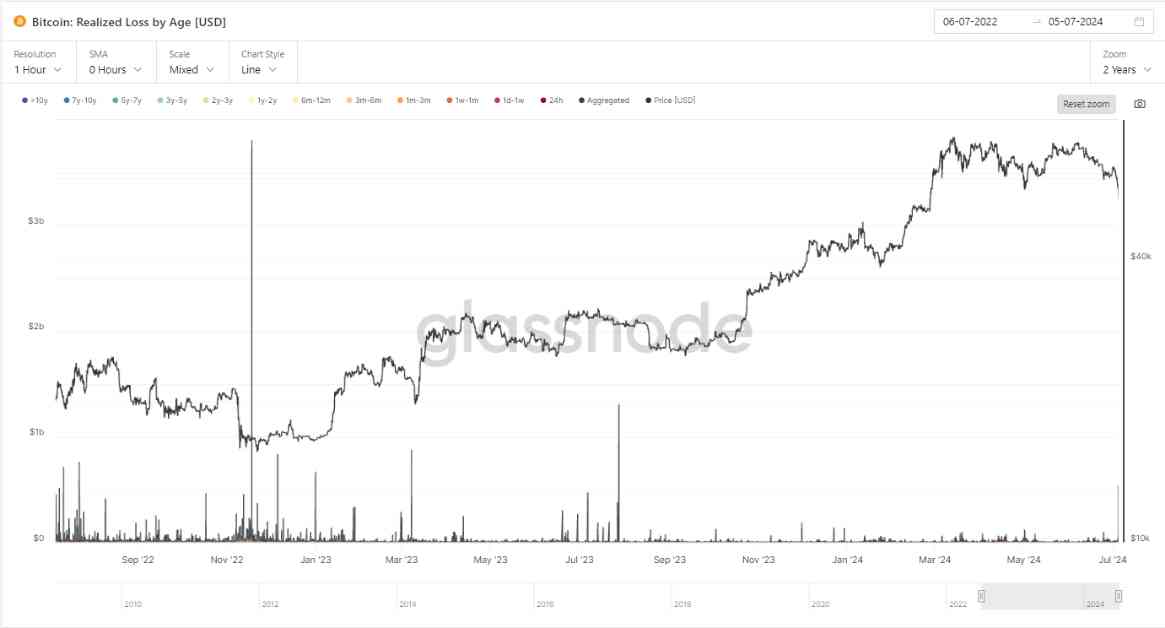

Bitcoin’s price recently took a hit, dropping to around $54,000, resulting in the fifth largest realized loss since the FTX collapse. The panic selling that ensued was primarily fueled by concerns related to Mt. Gox. Within just one hour on July 5, Bitcoin’s aggregated realized loss spiked to a staggering $814 million. Of this amount, $587 million in losses were experienced by short-term holders who had held Bitcoin for one to three months.

This significant sell-off underscores the vulnerability of short-term holders compared to long-term investors. A pattern observed on July 4 revealed that short-term holders were holding 2.5 million BTC at a loss, indicating a potential risk factor for a Bitcoin correction, surpassing the impact of Mt. Gox.

Interestingly, long-term holders remained steadfast during the turmoil, contributing minimally to the overall selling pressure. Their resilience suggests a strong belief in Bitcoin’s long-term potential, which stands in stark contrast to the short-term market fluctuations driven by newer investors reacting to immediate news events.

In the face of these developments, it is essential to consider the implications for the broader cryptocurrency market. The sell-off triggered by the FTX collapse and Mt. Gox panic serves as a reminder of the volatile nature of the digital asset space. Investors, both new and seasoned, must exercise caution and conduct thorough research before making investment decisions.

Furthermore, the data provided by Glassnode sheds light on the different cohorts of Bitcoin holders and their corresponding realized losses. Understanding these dynamics can help investors navigate market fluctuations more effectively and make informed choices based on their investment horizon and risk tolerance.

As the cryptocurrency market continues to evolve, staying informed about key developments and trends becomes increasingly important. By keeping a close eye on market insights and data reports, investors can position themselves to capitalize on opportunities and mitigate risks in this rapidly changing landscape.