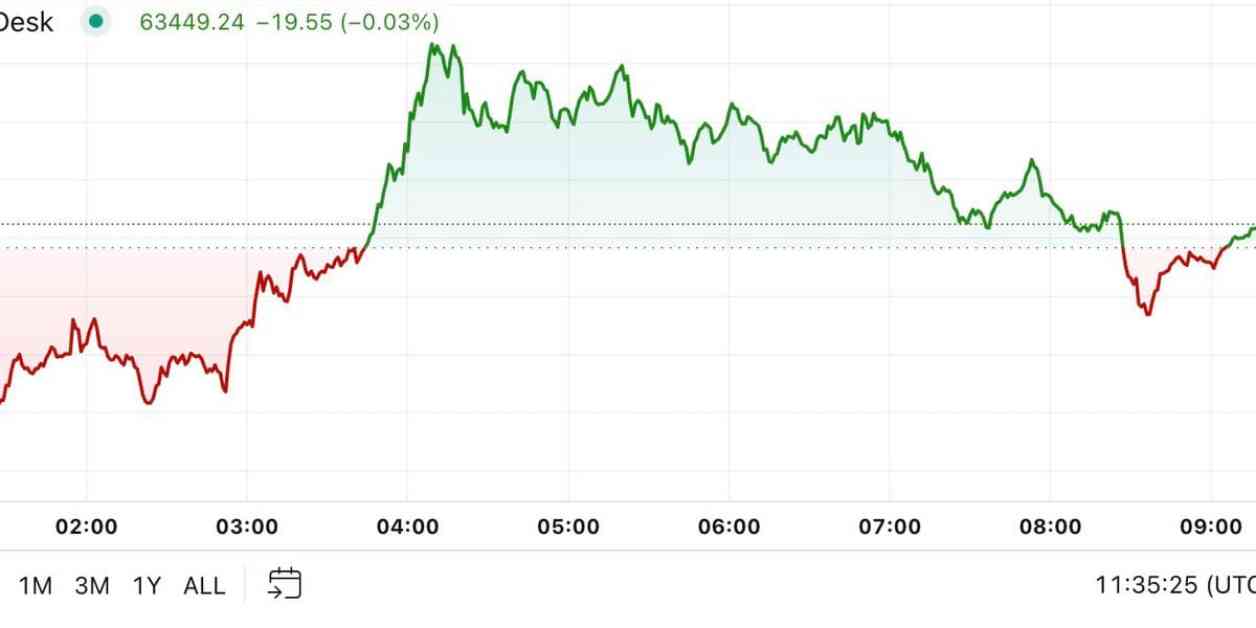

Bitcoin has continued its upward trajectory, with the price of the cryptocurrency hitting above $64,000 during the Asian morning. This surge comes as the Bank of Japan decided to keep rates unchanged, signaling positivity for risk assets. While Bitcoin has since settled around $63,500, it remains 1.9% higher in the last 24 hours. The BoJ’s decision to maintain rates has helped avoid a repeat of the rate hike in July, which led to a decline in crypto markets. Traders are optimistic about riskier assets like BTC, citing macroeconomic data as a driving force. QCP Capital traders noted that the US 2Y/10Y treasury spread, an indicator of recession, has recently steepened to +8bps, reflecting market optimism and a shift towards risk-on assets.

Ether, on the other hand, has been underperforming against the wider crypto market this year, gaining only around 8% compared to Bitcoin’s 40%. However, a new report by Steno Research suggests that Ether may be ready to shine once again. During the last bull market, ETH saw significant growth due to increased onchain activity from DeFi, stablecoin issuance, and NFTs. With the Federal Reserve’s recent interest-rate cut expected to boost onchain activity, Ethereum is poised to benefit greatly. Analysts at Steno Research highlighted that Ethereum’s active addresses remain strong, especially with the growing adoption of rollups. Additionally, the network’s transactional revenue appears to have bottomed in August, indicating positive growth potential for Ether.

In a rare occurrence, more than 250 “Satoshi era” BTC were moved on Friday. This refers to the period between 2009 and 2011 when Bitcoin’s pseudonymous creator Satoshi Nakamoto was active in the community before disappearing. The Bitcoin, mined in the early days of the cryptocurrency, were transferred in transactions of 50 BTC to new wallets during the European morning. This event follows previous instances where “Satoshi era” Bitcoin became active, including a wallet dormant for 11 years transferring $30 million worth of the asset in July 2023. Another wallet also transferred 1,005 BTC to a new address in August. These movements of long-dormant Bitcoin wallets have sparked curiosity and speculation within the crypto community.

The correlation between Bitcoin’s price and its hashrate has been a topic of interest for many in the crypto space. A chart showing the extreme divergence of a 30-day correlation at -50% suggests that the two could be set to converge, either through the price rising higher or the hashrate moving lower. This data from Glassnode indicates a potential shift in the relationship between Bitcoin’s price and hashrate, which could have implications for the future of the cryptocurrency market.

As the cryptocurrency market continues to evolve, it is essential to stay informed about the latest developments and trends. Whether it’s Bitcoin reaching new heights, Ether preparing for a resurgence, or movements in long-dormant Bitcoin wallets, the crypto space is always full of surprises. Stay tuned for more updates on the ever-changing world of digital assets.