Bitcoin Transactions Experience Significant Drop in Volume

In a surprising turn of events, Bitcoin transactions have seen a drastic decline of over 50% in just one week. This sharp decrease in activity has left many in the cryptocurrency community wondering about the reasons behind such a significant drop.

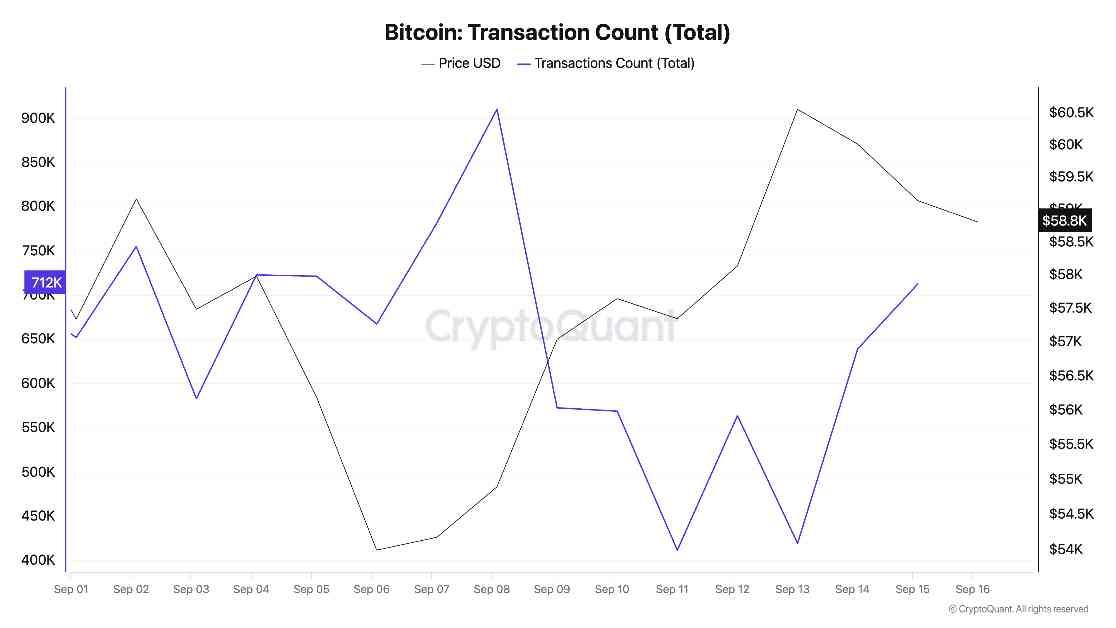

Between September 8th and September 11th, the total number of Bitcoin transactions plummeted from 909,000 to 412,000. This sudden decrease in transaction volume has raised concerns about the overall health of the Bitcoin market and the factors influencing this downward trend.

Market Cool Down and Reduced Trading Volume

The decline in Bitcoin transactions aligns with a noticeable drop in network activity, indicating a market cooldown. This decrease in trading volume comes after several days of saturation, suggesting that market participants may be taking a step back to reassess their strategies and positions.

Despite the sharp decline in transaction volume, there is some hope on the horizon. By September 15th, the total number of transactions had started to recover, reaching around 712,000. This uptick in activity can be attributed to Bitcoin’s break above $59,000, which reignited interest and trading volume in the market.

Shift in Institutional Activity and Market Liquidity

One of the key factors contributing to the decline in Bitcoin transactions is a reduction in large-scale transfers. The total number of tokens transferred dropped from 1.39 million on September 8th to 548,518 by September 15th, indicating a shift away from institutional activity or reduced market liquidity.

Analyzing the mean and median number of tokens transferred per transaction further supports this observation. On September 8th, the median number of tokens transferred was 0.0008 BTC, with a mean of 0.594 BTC. This discrepancy suggests that while most transactions were small, the market was dominated by a few high-value transfers.

Intermittent Bursts of Large Transactions

The spike in the mean number of tokens transferred to 3.032 BTC on September 11th indicates a period of substantial transactions, likely carried out by institutional players or whales. However, by September 15th, the mean dropped to 0.820 BTC, while the median remained low at 0.0003 BTC. This shift back to more typical trading activity signals a decrease in large-scale transfers and a return to normal market conditions.

Overall, the data paints a picture of a market characterized by intermittent bursts of large transactions, followed by periods of reduced activity. Despite consistent participation from retail and small-time traders, major players continue to wield significant influence over market sentiment.

In conclusion, the recent decline in Bitcoin transactions highlights the dynamic nature of the cryptocurrency market. While fluctuations in activity are to be expected, understanding the underlying factors driving these changes is crucial for investors and traders alike. As Bitcoin continues to evolve and adapt, staying informed and prepared for shifting market conditions will be key to navigating the volatile world of cryptocurrency.