Big whales are not selling, but amassing Bitcoin, since the purchase price of BTC consolidates under $60,000.

This trend coincides with strengthening on-chain principles, like whale and speech action.

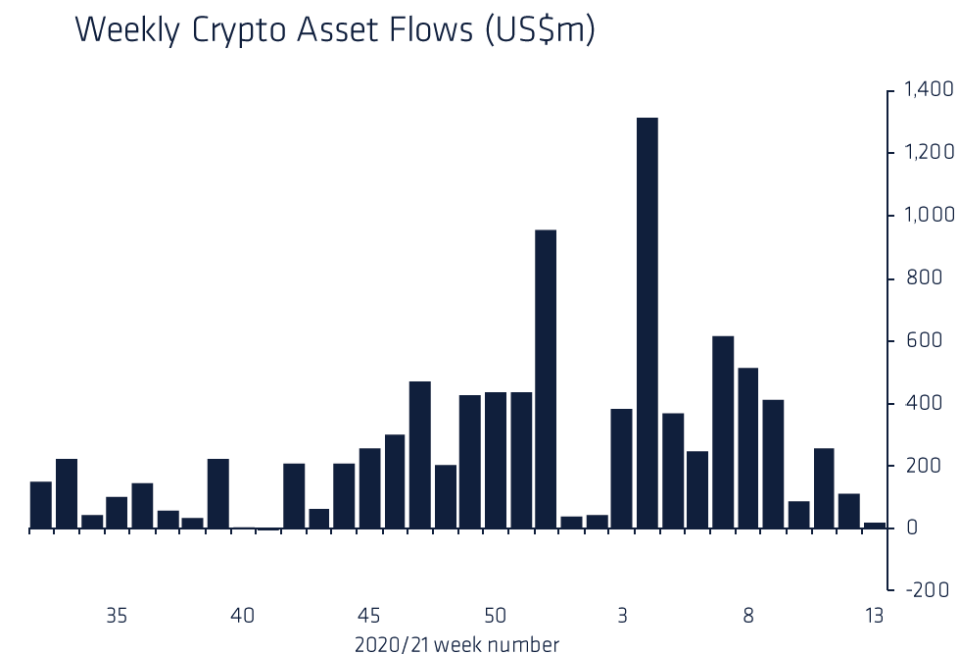

Considering that the Bitcoin rally started to quicken in November 2020, the average active speech has improved in tandem.

The upside tendency is the most powerful when supported by onchain tendencies”

It demonstrates that on-chain tendencies are supplementing both brief and long-term Bitcoin cost cycles.

Big whales Aren’t selling but amassing Bitcoin

According to the statistics from Santiment, large Bitcoin whales have been largely amassing Bitcoin as over 35,000 BTC has left trades in the previous 30 days. The most recent outflows also have pushed down trades’ BTC reservations to the lowest rates since early March earlier BTC hit fresh all-time highs over $60,000.

The Santiment group composed :

“As you would expect, not all #Bitcoin’s whales are acting in unison.

The graph indicates that 1,000 BTC into 10,000 BTC addresses are promoting, but analysts out of Whalemap stated this variety is a challenging range to test.

This variety may include exchange speeches, which aren’t labeled by the majority of on-chain data collecting platforms, therefore ideally, it might be more precise to compare 100 BTC into 1,000 BTC, then 10,000+ BTC holding speeches.

Whalemap analysts advised Cointelegraph:

“From the 1k-10k ring there are a great deal of exchanges Thus this might be part of it, because they’re decreasing the accessibility.

Furthermore, researchers in Glassnode discovered that during bull markets, older coins move more often.

As long distance holders proceed to market, it places substantial selling pressure on Bitcoin. Nonetheless, in the present stage of the cycle, the frequency of older BTC moving is considerably lower than 50 percent, or at which BTC awakened in prior cycles.

Glassnode investigators clarified :

“In bull markets older coins have a tendency to proceed more. This raises the relative supply of coins that are younger from the community. At preceding $BTC tops, approximately 50 percent of this #Bitcoin distribution has been younger than 6 weeks. We’re currently considerably below this amount (36 percent ).”

Bull trend intact provided that $55,000 service is defended

Since Cointelegraph reported, once the 10-year Treasury yield starts climbing, the risk-on markets generally have a hit, especially in the long run.

But since on-chain data stays optimistic for Bitcoin, provided that the 55,000 support region remains safeguarded, the bullish market arrangement would increase the likelihood of a bigger rally.