On October 31, Bitcoin celebrated its 16th birthday, marking the day when Satoshi Nakamoto introduced the whitepaper that revolutionized the financial world. At 16, Bitcoin is no longer seen as a mere experiment but is entering a crucial phase where its capabilities are being put to the test on a larger scale. Bitcoin is like a teenager getting its driver’s license, ready to navigate the complex roads of the global financial system. The big question now is: can Bitcoin handle the challenges that lie ahead?

Bitcoin has come a long way from being considered just “digital gold.” Today, it plays a fundamental role in the global financial infrastructure. The year 2024 has witnessed the emergence of Bitcoin Layer 2s, Ordinals, and increased institutional adoption, signaling a pivotal moment in Bitcoin’s evolution.

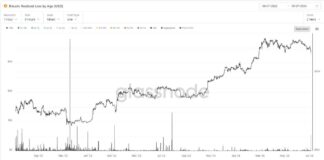

Perhaps the most significant development in Bitcoin’s 16th year has been the entry of institutional investors. The approval of Bitcoin ETFs by major financial players such as BlackRock, Fidelity, and Invesco marked a historic shift in the perception of Bitcoin. These ETFs have attracted over $1.5 billion in assets under management (AUM) collectively, injecting a substantial amount of capital into the market. The involvement of institutions like BlackRock, which manages trillions of dollars in assets, indicates that Bitcoin is now being taken seriously as a significant player in the global financial landscape.

As Bitcoin absorbs billions in institutional capital, the challenge is to maintain its decentralized nature while accommodating this influx. The focus for those working on Bitcoin is to ensure that it remains permissionless and resilient even as it gains mainstream acceptance.

The evolution of Layer 2 solutions like Lightning has transformed the way Bitcoin is used, particularly in regions with volatile currencies. While Lightning has proven to be beneficial for payments in such areas, its adoption in developed markets has been slower than expected. However, this slower adoption should be viewed as a sign of Bitcoin maturing into a broader infrastructure layer rather than a setback.

In the new era of Bitcoin, the distinction between BTC as an asset and Bitcoin as the underlying infrastructure is becoming more apparent. Transactions on the base layer (L1) are now seen as high-value settlements, while Layer 2 solutions offer a cheaper and faster way to transact on-chain. Projects like Stacks, with its Nakamoto upgrade, are enhancing Bitcoin’s liquidity and integration into both traditional and decentralized financial systems, offering innovative solutions that maintain decentralization.

Technological advancements such as BitVM and OP_Cat are introducing complex smart contracts and covenant-based programming to Bitcoin, paving the way for more sophisticated governance models. Moreover, projects like Coinbase’s cbBTC are tokenizing Bitcoin for various applications, expanding its utility beyond traditional investment strategies.

At 16, Bitcoin is evolving into more than just a digital asset; it is becoming the foundation for a decentralized world. With numerous Layer 2 solutions being developed, Bitcoin’s potential is expanding far beyond its original purpose. While institutional interest signifies a significant milestone, it also raises concerns about preserving Bitcoin’s core values of decentralization and permissionlessness in the face of increasing institutional influence.

As Bitcoin continues to grow and evolve, the key is to have the right tools, developers, and vision to ensure that its foundational principles are upheld. The future of Bitcoin is heading towards a realm where decentralized finance, digital identities, and smart contracts are built on its infrastructure. The journey ahead may be vast, but with the guidance of skilled builders, the possibilities for Bitcoin are endless.