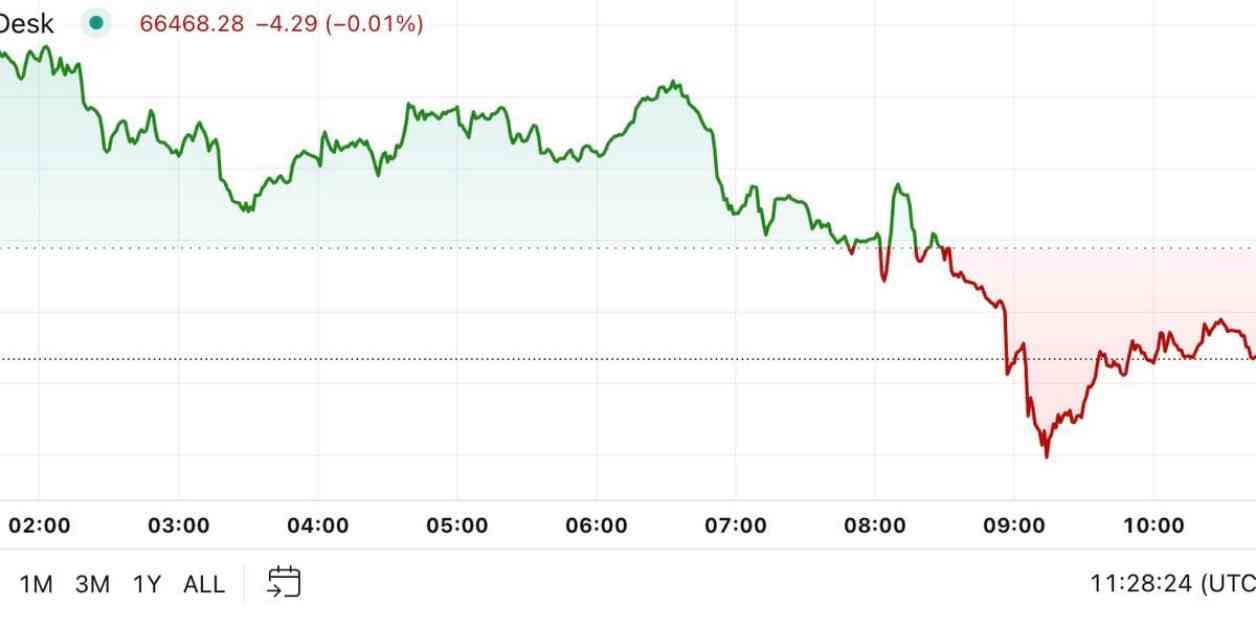

Bitcoin’s price took a hit, dropping below $67,000 and causing a ripple effect across the cryptocurrency market. In the last 24 hours, BTC fell by 1.3% to under $66,500, leading to a 1.5% decrease in the CoinDesk 20 Index. Bitcoin ETFs also saw a decline after seven consecutive days of gains, losing nearly $80 million. Dogecoin (DOGE) experienced the biggest losses among major tokens, dropping by 3.8%, while Ethereum (ETH) and Ripple (XRP) both saw losses of around 1.5%. DOGE had been on an upward trend in the previous week following an endorsement by Elon Musk.

One of the factors contributing to the stagnation in the crypto market’s growth is the slowing down of stablecoin issuance. Bitcoin briefly surpassed $69,000 before faltering, highlighting the importance of stablecoin liquidity for sustaining higher cryptocurrency prices. The lack of growth in stablecoin volume since late September is seen as a potential obstacle to the broader crypto market’s expansion. According to Alex Kuptsikevich, senior market analyst at FxPro, stablecoins play a crucial role in providing liquidity for quick purchases of various coins of interest.

Despite the uncertainty surrounding the U.S. presidential election, some traders believe that Bitcoin is poised to reach new highs regardless of the outcome. While Donald Trump has been viewed as the more crypto-friendly candidate, leading to assumptions that a Republican victory would benefit BTC, others believe that the asset has the potential to rise under either administration. Both candidates have expressed support for cryptocurrencies to appeal to voters, but the actual impact of their policies remains to be seen. Jeff Mei, chief operating officer at crypto exchange BTSE, noted that the market is responding positively to the upcoming change in administration, indicating that traders and investors view any change as a positive development.

In other news, the cumulative trading volume on Uniswap, the largest Ethereum-based decentralized exchange, has surpassed $2 trillion. The success of Uniswap underscores the growing popularity of decentralized trading platforms and their increasing market share compared to centralized exchanges. DEXs have seen their market share rise from 3.8% in January 2021 to the current level of 14.1%, signaling a shift towards decentralized trading.

As the cryptocurrency market continues to evolve, it is essential to stay informed about the latest trends and developments. CoinDesk is committed to providing accurate and unbiased coverage of the industry, adhering to strict editorial policies to ensure integrity and independence in its reporting. Stay tuned for more updates on the crypto market and emerging trends in digital assets.