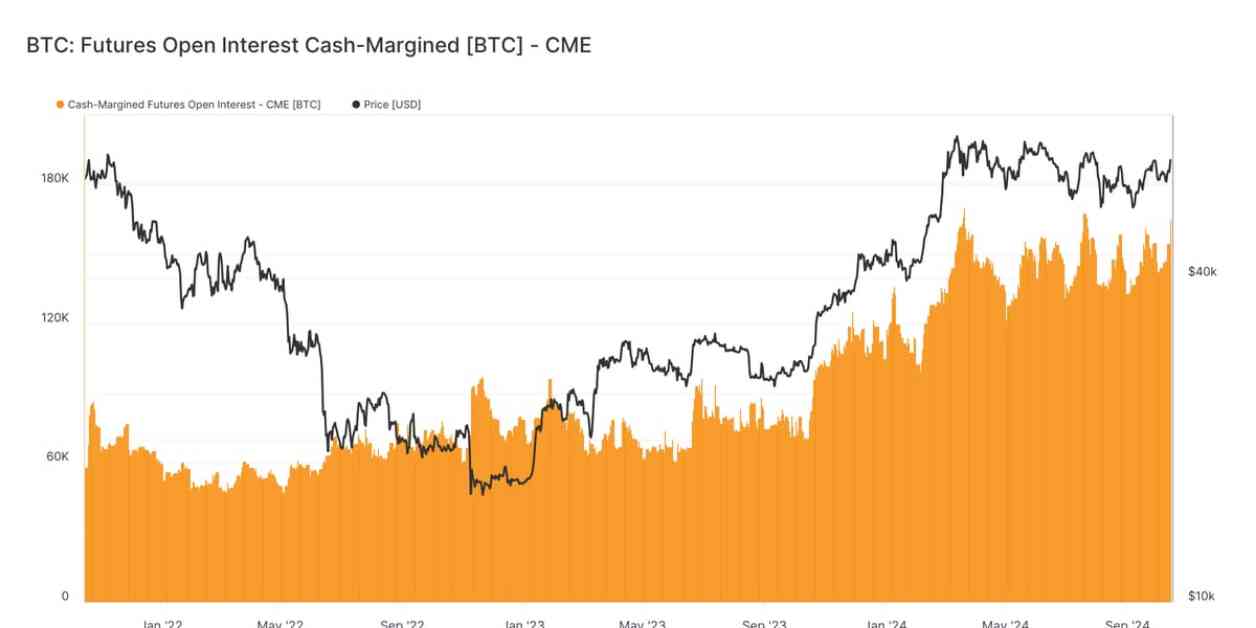

Cash-margined Bitcoin futures contracts are gaining popularity as open interest in these futures has reached record highs. Currently valued at approximately 478,000 BTC ($31.8 billion), the open interest in cash-margined futures has hit an all-time high of 384,000 BTC ($25.5 billion). This surge in interest is largely being driven by institutional activity on the CME.

The data from Glassnode shows that the CME futures accounted for 40% of the cash-margined tally on Monday. Cash-margined open interest has been on the rise for the past two years, while open interest in crypto-margined futures has been declining. Crypto-margin now only accounts for around 18.2% of the total open interest.

Cash-margined contracts are considered to be less volatile compared to crypto-margin contracts. This is because cash-margined contracts use stablecoins or dollars as collateral, which are more stable assets. This stability in collateral makes cash-margined contracts less susceptible to forced liquidations and ultimately leads to less volatility in the market.

The increasing activity in cash-margined futures, especially on the CME, indicates growing institutional participation in the derivatives market. It is likely that sophisticated investors are using CME futures to hedge their positions or to engage in market-neutral trading strategies.

In October 2023, CME became the largest futures exchange for the first time, surpassing Binance with over 30% market share. This growth was driven by traders anticipating the launch of U.S.-based spot ETFs, which eventually went live in January.

Overall, the surge in open interest in cash-margined Bitcoin futures signals a growing trend towards institutional involvement in the cryptocurrency market. This shift towards more stable forms of margining could potentially lead to a more sustainable and less volatile market environment in the future.