Coinbase has announced that it will be delisting Wrapped Bitcoin (WBTC) and halting trading on December 19th. This decision comes as Coinbase’s cbBTC has gained traction in the market, reaching 10% of WBTC’s market cap, particularly on platforms like Aave.

The reason for delisting WBTC was not specified by Coinbase, but it comes after WBTC issuer BitGo implemented a new custody model in collaboration with BiT Global, connected to TRON founder Justin Sun. This move raised concerns within the community about Sun’s potential influence over WBTC, leading to some DeFi protocols voting to remove WBTC as collateral.

In response to the gap left by WBTC in the synthetic Bitcoin market, Coinbase introduced cbBTC. Since its launch in September, cbBTC has seen significant adoption on Aave, with its share of the synthetic Bitcoin market increasing from 3% to 17% in just a few weeks. This rapid growth has allowed cbBTC to capture nearly 10% of the market previously dominated by WBTC.

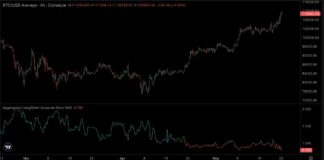

Unlike stablecoins, wrapped assets like WBTC and cbBTC are not pegged to BTC and can trade at values that differ from the underlying asset. Recently, WBTC has consistently traded at a discount compared to BTC, indicating market fluctuations. As cbBTC gains momentum, it signals a potential shift in the competitive landscape for wrapped Bitcoin assets.

Overall, Coinbase’s decision to delist WBTC and introduce cbBTC reflects the evolving dynamics within the cryptocurrency market, particularly in the realm of synthetic assets. This move not only impacts traders on the platform but also highlights the growing importance of diversification and competition in the cryptocurrency space. As the market continues to adapt and innovate, it will be interesting to see how these changes influence the broader ecosystem of digital assets.