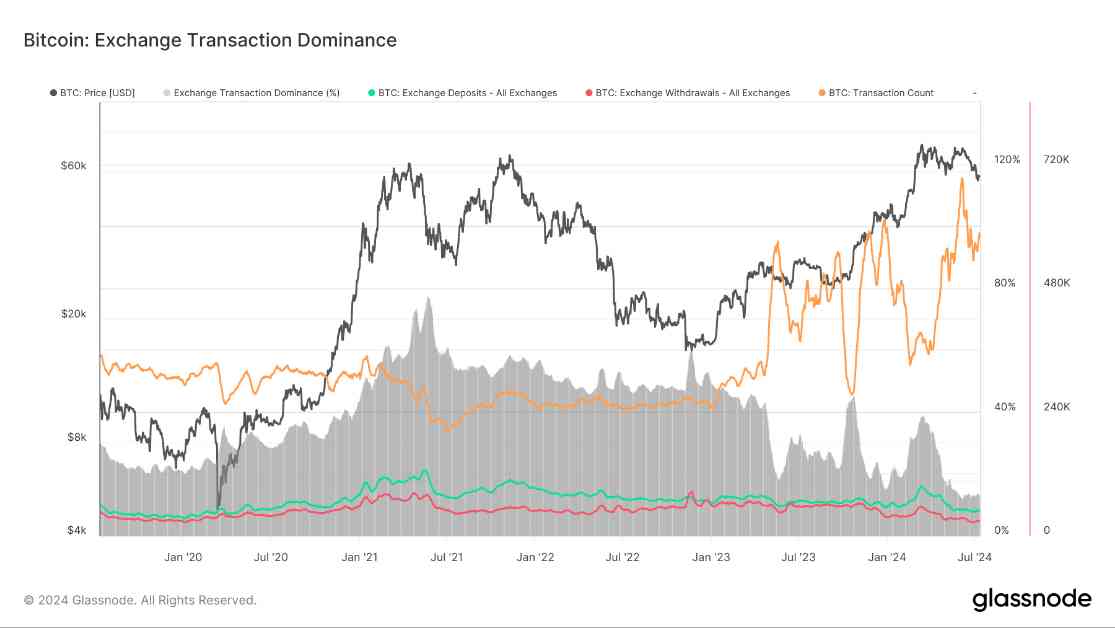

The latest data shows that exchange withdrawals in the crypto market have hit a 5-year low, with only 28.5k BTC being withdrawn. This indicates that traders are holding onto their assets rather than moving them to exchanges for trading or selling.

This decrease in withdrawals could be attributed to several factors. One possible reason is that traders are becoming more confident in the long-term potential of cryptocurrencies and are choosing to hold onto their assets rather than engage in short-term trading. Additionally, the recent volatility in the market may have led some traders to adopt a more cautious approach, opting to keep their assets in their wallets rather than risk losing them in trades.

It is worth noting that this trend of low exchange withdrawals is not necessarily a negative sign for the crypto market. In fact, it could indicate a growing level of maturity and stability in the market, as traders are becoming more strategic and patient in their investment decisions.

Despite the decrease in exchange withdrawals, it is important for investors to remain vigilant and stay informed about market trends and developments. The crypto market is known for its volatility, and sudden changes in market conditions could impact the value of assets. By staying informed and making informed decisions, investors can navigate the market more effectively and protect their investments.

In conclusion, the recent low in exchange withdrawals in the crypto market suggests that traders are adopting a more cautious and long-term approach to their investments. This trend could indicate a growing level of maturity and stability in the market, but investors should continue to stay informed and vigilant to navigate the market effectively.