Decoding Algo Trading in Crypto Markets: A Guide for All

Algorithmic trading, often referred to as “algo trading,” has become a prominent feature in the financial landscape, especially in the dynamic world of cryptocurrency. Despite common misconceptions that it is reserved for high-frequency traders with significant resources, algo trading is fundamentally about automating trading strategies to create a systematic and unbiased approach to trading decisions. This article aims to demystify algo trading and explore its potential to democratize trading strategies, leading to broader market participation.

Dispelling Myths and Unveiling Potential

Contrary to popular belief, algo trading encompasses a broad range of trading strategies beyond high-frequency trading (HFT). In developed markets, algorithmic trading makes up a substantial portion of overall trading volume, with many trades automated to replace human errors with disciplined, data-driven decisions. These algorithms can range from simple rules like moving average crossovers to sophisticated predictive models, enhancing the precision and structure of trading decisions in a market that operates 24/7.

While algorithmic trading faces challenges, such as adapting to unpredictable market shifts and evolving technologies, its potential for growth is significant. The global algorithmic trading market size is projected to reach $65.2 billion by 2032, indicating a steady increase as both retail and institutional traders adopt these technologies. Algo trading has the capacity to facilitate faster, data-informed trades and democratize access to trading strategies previously exclusive to institutional players, transforming the crypto market into a more accessible and resilient landscape for all traders.

Algo Trading Isn’t Just for Big Players

One prevalent misconception is that algo trading requires extensive infrastructure and data resources, limiting its accessibility to elite traders. However, many algorithms can be implemented with basic tools, focusing on strategies like dollar-cost averaging rather than high-speed trading advantages. Dispelling the myth that algo trading is exclusive to a select few is essential in expanding access to these strategies for all traders, particularly in the crypto market where algorithmic trading plays a significant role in interpreting real-time market shifts.

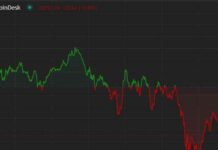

In the crypto market, the influence of external factors like social media posts or regulatory announcements can have a substantial impact. Algorithms leveraging natural language processing (NLP) can gauge sentiment from these sources, enabling faster responses to market sentiment changes. While powerful, these models require caution, as they can amplify irrational market movements. Additionally, machine learning algorithms can identify market patterns to inform trade decisions, but continuous refinement and adaptation are crucial in the dynamic crypto market landscape.

Institutional Tools for All Traders

An exciting development in algo trading is the increasing accessibility of tools such as NLP and machine learning, allowing even novice traders to implement automated strategies with minimal programming knowledge. This democratization of algorithmic trading tools levels the playing field for retail traders, enabling a broader range of market participants to compete and implement their trading strategies effectively.

As the crypto market evolves, algorithmic strategies must adapt to new trends like meme coins and regulatory frameworks such as MiCA in Europe. Innovations like decentralized exchanges will also influence trading approaches in the future. Algo trading contributes to a more resilient market by incorporating information efficiently into prices and promoting systematic trading decisions, ultimately fostering a diverse and accessible market for all participants.

In conclusion, responsible algo trading can drive growth and resilience in digital asset markets, positioning crypto as the future of finance.