Bitcoin saw a significant surge last week, rallying 17%, marking its second-best week of the year. The spot volume of Bitcoin on Coinbase also experienced a sharp increase, reaching levels close to the high seen in March 2024. Additionally, exchange balances for the largest cryptocurrency hit a year-to-date low, indicating a rise in buying pressure based on data from Glassnode.

The impact of Donald Trump’s U.S. presidential election victory was evident in the cryptocurrency market, with Bitcoin reaching a record high and the total cryptocurrency market cap surpassing $2.7 trillion, a peak for the year. Bitcoin currently holds a market capitalization of $1.16 trillion, making it the ninth-largest financial asset by market cap.

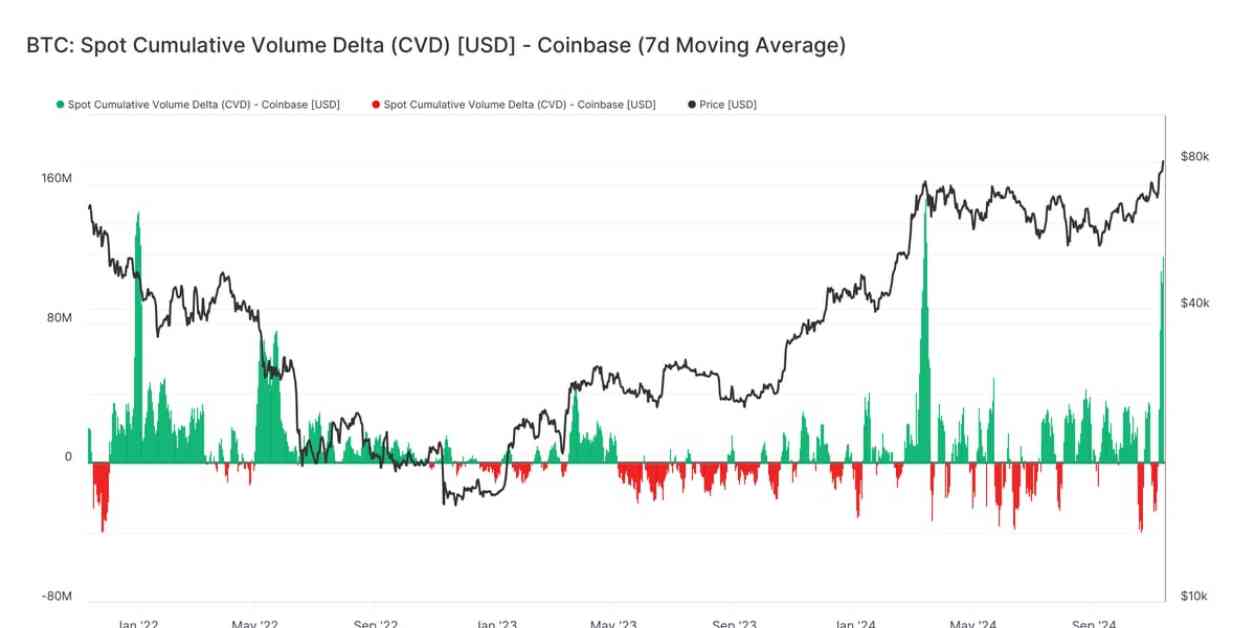

To determine whether Bitcoin’s price could potentially continue to rise or if it has hit a local peak, it is crucial to understand the factors driving the current rally. The surge in Coinbase spot volume, particularly in the spot cumulative volume delta (CVD), which measures the net difference between buying and selling trade volumes, highlights increased activity from U.S. investors and institutions.

One of the key areas of interest is the inflows into U.S.-listed spot exchange-traded funds (ETFs) and whether they are solely driven by spot buying or part of a basis trade strategy. The basis trade involves taking advantage of the price difference between spot and futures prices, with investors holding long positions in ETFs while shorting the Chicago Mercantile Exchange (CME) futures market.

While ETF inflows initially saw significant growth earlier this year, the impact on Bitcoin’s price has been more muted, suggesting that the ETFs are operating on a delta-neutral strategy. Despite this, the CEO of CF Benchmarks noted that a substantial portion of ETF inflows were due to the basis trade strategy.

Furthermore, the decrease in Bitcoin balances on exchanges to a year-to-date low indicates a growing interest in acquiring more Bitcoin among owners. This trend has been observed across various exchanges such as Coinbase, Binance, and Bitfinex, pointing towards a shift in investor behavior towards holding more Bitcoin rather than keeping it on exchanges.

Overall, the current surge in Bitcoin’s price is driven by a combination of factors, including increased spot volume on Coinbase, ETF inflows, and a reduction in exchange balances. Understanding these dynamics is essential in gauging the future price movements of Bitcoin and the broader cryptocurrency market. As the market continues to evolve, monitoring key indicators such as spot volume, exchange balances, and ETF activity will be critical in assessing market trends and investor sentiment.