Stablecoins are increasingly gaining popularity in emerging markets, with users turning to these digital assets for everyday financial activities such as savings, currency conversion, and cross-border payments. A recent report by digital asset investment firm Castle Island Ventures and hedge fund group Brevan Howard sheds light on the growing adoption of stablecoins in countries like Brazil, Nigeria, Turkey, Indonesia, and India.

According to the report, stablecoins are not only being used for accessing cryptocurrency markets but are also serving a variety of practical purposes in the daily lives of individuals in these regions. The survey, which encompassed over 2,500 cryptocurrency users, revealed that a significant portion of respondents have utilized stablecoins for different financial activities.

Among the key findings, 69% of the participants indicated that they have converted their local currency into stablecoins, highlighting the growing trend of using these digital assets as a means of preserving value and protecting against currency fluctuations. Additionally, 39% of respondents reported using stablecoins to purchase goods or services, while 30% utilized stablecoins for business transactions. Moreover, 23% mentioned that they have either paid or received their salary in stablecoins, indicating a shift towards digital currencies in the payment ecosystem.

The survey also unveiled that users in emerging markets prefer utilizing stablecoins on blockchain networks over traditional banking systems. This preference is driven by factors such as increased efficiency, the potential to earn yield, and reduced chances of government interference. Tether (USDT), the largest stablecoin by market capitalization, emerged as the preferred choice among respondents due to its network effects, user trust, liquidity, and track record compared to other stablecoins.

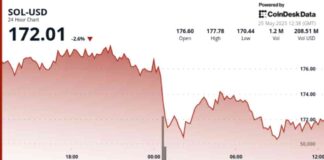

In terms of blockchain rails for stablecoin transactions, Ethereum (ETH) was the most favored choice among users, followed by Binance Smart Chain (BNB), Solana (SOL), and Tron (TRX). The preference for these blockchain networks underscores the importance of a robust infrastructure for facilitating seamless and secure stablecoin transactions.

Nic Carter, general partner at Castle Island, emphasized the significance of the survey findings, stating, “We felt there was a lack of data around how folks are actually using stablecoins around the world, especially in emerging markets. What we found validated our beliefs about stablecoins: they are being used not just for crypto trading but increasingly feature in the ordinary economic lives of these individuals.”

Stablecoins have established themselves as a $160 billion asset class within the crypto space, with their prices pegged to external assets, primarily the U.S. dollar. While serving as a bridge between cryptocurrencies and fiat money, stablecoins have also emerged as a safe haven asset and a cost-effective payment solution in developing regions with volatile currencies and underdeveloped banking systems.

As the adoption of stablecoins continues to grow globally, it is evident that these digital assets are playing a pivotal role in reshaping the financial landscape and providing individuals with alternative means of managing their finances. With their increasing utility and functionality, stablecoins are set to become an integral part of the digital economy, offering users a secure and efficient way to engage in financial transactions.

Impact on Emerging Markets

The rise of stablecoins in emerging markets signifies a significant shift in how individuals in these regions are managing their finances. With traditional banking systems often plagued by inefficiencies, high transaction costs, and limited access to financial services, stablecoins offer a viable alternative that is not only more efficient but also more inclusive.

In countries like Brazil, Nigeria, Turkey, Indonesia, and India, where currency devaluations and economic uncertainties are common, stablecoins provide a stable store of value that can safeguard against inflation and preserve purchasing power. By converting their local currency into stablecoins, users can mitigate the risks associated with volatile fiat currencies and have greater control over their financial assets.

Moreover, the use of stablecoins for cross-border payments has opened up new possibilities for individuals to conduct transactions with friends and family members in different countries. The low fees and fast transaction times associated with stablecoin transfers make it a convenient option for remittances, enabling seamless and cost-effective money transfers across borders.

Regulatory Considerations

As the adoption of stablecoins continues to expand, regulators are increasingly focusing on the regulatory framework surrounding these digital assets. The decentralized nature of stablecoins, coupled with their potential to disrupt traditional financial systems, has raised concerns among regulatory authorities about issues such as money laundering, terrorist financing, and consumer protection.

In response to these concerns, countries around the world are exploring regulatory measures to ensure the safe and responsible use of stablecoins. Hong Kong, for example, is planning to introduce stablecoin legislation to provide clarity on the legal status of stablecoins and establish guidelines for their issuance and use. By creating a regulatory framework that addresses key concerns while promoting innovation, regulators can strike a balance that fosters the growth of stablecoins while safeguarding against potential risks.

The Future of Stablecoins

Looking ahead, the future of stablecoins appears promising, with these digital assets poised to play a central role in the evolving financial landscape. As more individuals and businesses recognize the benefits of stablecoins for savings, payments, and currency conversion, the demand for these digital assets is expected to continue growing.

Innovations in blockchain technology and the expansion of decentralized finance (DeFi) platforms are likely to further enhance the utility and accessibility of stablecoins, making them an integral part of the digital economy. With increased adoption and acceptance, stablecoins have the potential to revolutionize the way financial transactions are conducted, offering users a secure, efficient, and transparent alternative to traditional banking systems.

In conclusion, the emergence of stablecoins as a preferred financial instrument in emerging markets underscores the transformative impact of digital assets on the global economy. As individuals and businesses increasingly turn to stablecoins for their financial needs, these digital assets are reshaping the financial landscape, providing a decentralized and efficient alternative to traditional banking systems. With their growing popularity and utility, stablecoins are paving the way for a more inclusive, accessible, and secure financial ecosystem for users around the world.