Ether’s price surged by 10% in the last 24 hours, exceeding $2,800, while other cryptocurrencies saw profit-taking. This increase is attributed to optimism surrounding DeFi after Donald Trump’s presidential victory. There are expectations of pro-crypto policies and deregulation under his administration, which is boosting investor confidence.

Trump’s potential policies could potentially reduce regulatory burdens, giving DeFi projects more freedom and potentially recognizing certain tokens as commodities rather than securities. This could lead to growth and innovation in the sector.

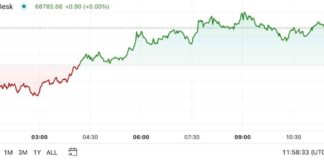

Despite being stuck between $2,300 and $2,600 levels, Ether (ETH) crossed $2,800 for the first time since early August, breaking out of range-bound trading. The ratio tracking the performance of Ether and Bitcoin slid to April 2021 levels, indicating a decrease in investor demand for ETH.

The DeFi sector is experiencing renewed optimism, with some investors seeing the potential for a bull market with Trump’s victory. Arthur Cheong, co-founder of DeFiance Capital, highlighted the progress of the DeFi Renaissance thesis with anticipated deregulation and crypto-friendly policies under the Republican administration.

Cheong’s viral thesis in early October suggested that DeFi applications could witness increased user base and token demand, supported by growing activity metrics and new money flowing into DeFi projects. This positive sentiment is further fueled by Trump’s promise to make the U.S. a leading hub for cryptocurrency, potentially leading to more favorable regulations for DeFi.

The sentiment in the market is shifting towards a more positive outlook for DeFi projects, with traders responding favorably to Trump’s presidency. Social media sentiment for DeFi is leading among trending sectors like AI and memecoins, indicating growing interest and optimism in the space.

Overall, the outlook for DeFi projects is optimistic, with the potential for growth and innovation under Trump’s administration. The market is responding positively to the anticipated deregulation and crypto-friendly policies, signaling a potential bull market for DeFi in the near future.