BNY Mellon, the oldest bank in the USA, has been aggressively invest in the electronic advantage market.

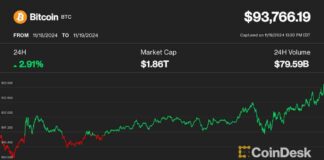

Cryptocurrency startup Fireblocks has increased $133 million in a Series C financing round.

“While we don’t have any plans to develop into a lender, we consider that our infrastructure will lend itself to power a totally new era of fiscal services.”

Seeing his company’s investment in Fireblocks, Micky Malka of Ribbit Capital stated,”We’re standing in the cusp of their largest transformation the world’s financial system has ever noticed,” adding that Fireblocks is in the”forefront of the revolution.”

Series C financing is generally geared toward more complex projects that have achieved a reasonable level of success. These businesses need additional capital to assist scale their services and products into new markets or perhaps to get other companies.

Fireblocks was set in 2018 by specialists of Israeli army intelligence such as Michael Shaulov, who formerly co-founded a cellular security startup, Lacoon Mobile Security. The company specializes in digital asset custody and operates on accelerating the rate of electronic transactions. According to the Wall Street Journal, the most recent funding round attracts Fireblocks’ evaluation to over $900 million, together with the company raising a total of $179 million up to now.

Fireblocks was a magnet for venture capital companies seeking to capitalize on the developing institutional requirement for Bitcoin (BTC) along with other cryptocurrencies.

During Fireblocks, banks and fintech businesses can connect into the cryptocurrency marketplace by providing custody, tokenization, asset management, trading, lending and payment options. Since its beginning three decades back, the organization claims to have guaranteed $400 billion in electronic assets on behalf of its clients.

BNY Mellon isn’t the only banking institution that’s been preparing to establish its crypto custody alternative. Deutsche Bank is also likely to move in the crypto custody company, together with supplying token and trading issuance services.

Bryan Routledge, associate professor of finance at Carnegie Mellon University, maintained that crypto custody isn’t so distinct from conventional services already provided by heritage banks. Maintaining a private and public key pair is vital,”But it is not that hard,” or shouldn’t be for many banks,” he said.