A significant transformation is taking place in the financial world as digital assets are gaining more attention and investment globally. The recent introduction of Bitcoin ETFs and the upcoming Ethereum ETFs have made it easier for institutional investors to enter this market. This shift is seen as a once-in-a-lifetime opportunity to be part of a new asset class with high growth potential and the ability to diversify investment portfolios.

One way to understand the value of Bitcoin as a diversification tool is by looking at its correlation with traditional markets like the Nasdaq Composite. Despite some fluctuations, the correlation has been relatively low, indicating that cryptocurrencies can act as a hedge against the movements of traditional equities and enhance the overall resilience of investment portfolios.

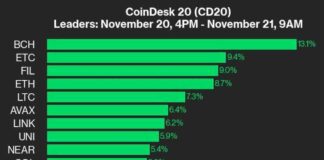

When it comes to choosing which digital assets to include in portfolios, it is crucial to be selective. While there are thousands of cryptocurrencies available, only a few, such as Bitcoin, Ethereum, Solana (SOL), and Chainlink (LINK), are considered essential. Investing in an index like the CoinDesk 20 can offer benefits such as diversification and risk management, as it captures the performance of the top 20 digital assets by market capitalization.

Navigating the crypto landscape can be challenging, especially for novice investors. Working with reputable asset managers is often the best approach, as they can provide guidance on investment strategies and handle complex aspects like liquidity and security. As digital assets continue to grow in importance, institutions that allocate capital to this asset class now are likely to gain a competitive advantage in the future.

Overall, digital assets are no longer just a curiosity but a significant part of the modern financial world. Institutions that proactively invest in this space stand to benefit from diversification, growth potential, and expert guidance. While there are risks involved, the opportunities presented by digital assets are too compelling to ignore in today’s financial landscape.