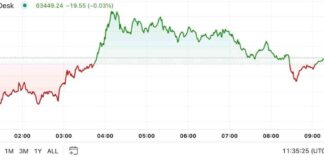

The recent surge in the crypto market, reaching a new all-time high of nearly $3.5 trillion, has been primarily driven by institutional capital flowing into Bitcoin and altcoins. According to Bitfinex insights, the influx of institutional funds has propelled Bitcoin to consistent all-time highs, with BTC peaking at $99,334 before a slight correction settled it at $95,611 over the weekend.

While long-term holders have been taking profits, the demand from new investors, particularly through exchange-traded funds (ETFs), has helped Bitcoin maintain its upward trajectory. In the past week alone, net inflows into US spot Bitcoin ETFs have exceeded $3.35 billion, indicating a strong interest in the cryptocurrency.

In addition to Bitcoin’s performance, the broader altcoin market, represented by the Total3 Index (excluding Bitcoin and Ethereum), has also seen significant growth, increasing by 23.2% – the most substantial move since April 2021. This surge in altcoin prices suggests growing investor interest, potentially fueled by market sentiment and regulatory developments.

Despite the bullish market sentiment, a minor correction or period of consolidation is expected, especially with upcoming macroeconomic events on the horizon. The release of the US Consumer Price Index and the Federal Open Market Committee minutes could introduce volatility to the market, leading to potential price swings.

Overall, while Bitcoin continues its ascent and outperforms traditional safe-haven assets like gold and silver, investors should remain vigilant and monitor market dynamics closely. With institutional capital driving the crypto rally, it’s essential to stay informed and prepared for potential corrections or periods of increased volatility in the market.