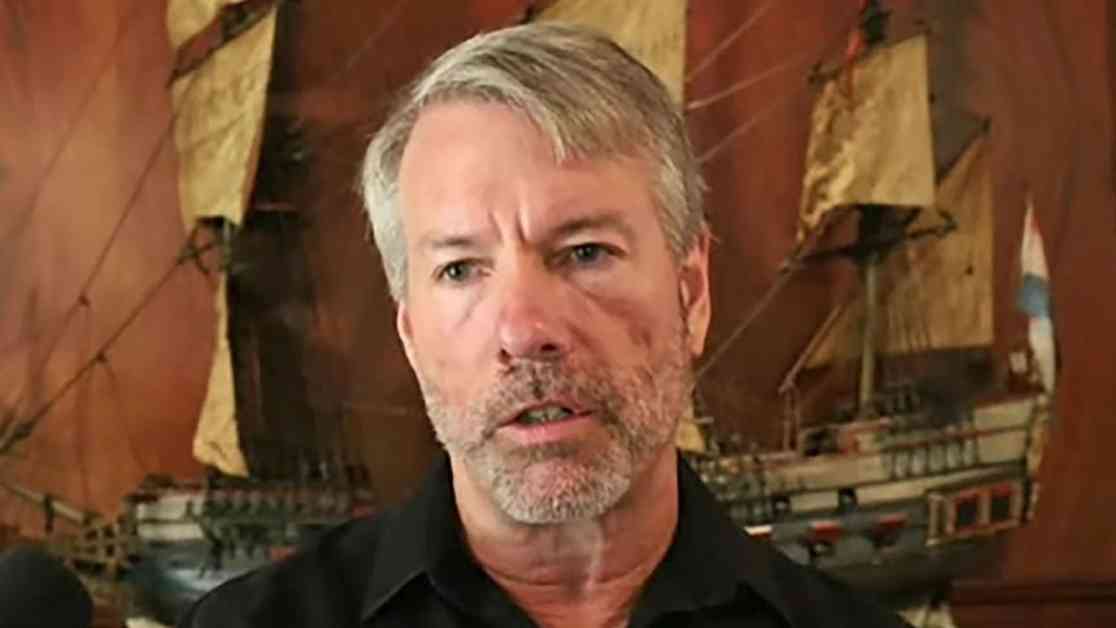

MicroStrategy, a Nasdaq-listed bitcoin development firm, made headlines with its recent announcement to issue $700 million convertible senior notes due in 2028. This move, spearheaded by Executive Chairman Michael Saylor, is part of the company’s ongoing strategy to bolster its bitcoin holdings and solidify its position as a major player in the cryptocurrency market.

The primary objective behind this issuance is to redeem $500 million worth of senior secured notes that were set to mature in 2028. By refinancing this debt, MicroStrategy aims to optimize its financial structure and potentially lower its interest expenses. The remaining $200 million from the offering will be allocated towards purchasing more bitcoin and for general corporate purposes.

This decision comes on the heels of MicroStrategy’s recent disclosure of acquiring an additional $1.1 billion worth of bitcoin, further solidifying its status as the largest corporate holder of the digital asset. With a total of 244,800 BTC in its treasury, valued at approximately $14.2 billion, MicroStrategy continues to demonstrate its unwavering commitment to bitcoin as a long-term investment.

Following MicroStrategy’s lead, several other public companies have begun exploring similar strategies to leverage debt issuance for acquiring bitcoin. Semler Scientific and Japanese investment adviser Metaplanet are among the entities that have followed suit, signaling a growing trend of corporate adoption of cryptocurrency as a treasury asset.

The decision to issue convertible notes reflects MicroStrategy’s confidence in the future of bitcoin and its belief in the long-term value proposition of the digital currency. By strategically leveraging debt to accumulate more bitcoin, the company aims to capitalize on potential upside opportunities in the evolving cryptocurrency market.

### Impact on Market Dynamics

MicroStrategy’s aggressive pursuit of bitcoin has not gone unnoticed in the financial markets. The company’s massive bitcoin holdings have positioned it as a key player in shaping the dynamics of the cryptocurrency market. As one of the largest institutional buyers of bitcoin, MicroStrategy’s actions have the potential to influence market sentiment and drive price movements.

The recent issuance of convertible notes by MicroStrategy is expected to have a ripple effect on the broader cryptocurrency ecosystem. By injecting additional capital into the market and increasing its bitcoin holdings, MicroStrategy could potentially contribute to the overall bullish outlook for bitcoin and other digital assets.

### Investor Sentiment and Market Response

The announcement of MicroStrategy’s plan to issue $700 million convertible notes has generated mixed reactions among investors and analysts. While some view this move as a strategic initiative to strengthen the company’s balance sheet and expand its exposure to bitcoin, others have raised concerns about the potential risks associated with leveraging debt for cryptocurrency investments.

The fluctuation in MicroStrategy’s stock price following the news highlights the sensitivity of investor sentiment to the company’s bitcoin-related activities. Despite experiencing a 4.9% decline in share value during regular trading hours, MicroStrategy remains resilient in its long-term vision for bitcoin accumulation and corporate treasury management.

### Future Prospects and Strategic Vision

Looking ahead, MicroStrategy’s decision to issue convertible notes underscores its commitment to pursuing innovative financial strategies to enhance shareholder value and drive sustainable growth. By leveraging debt to acquire more bitcoin, the company aims to capitalize on the potential upside of the digital currency while mitigating risks associated with traditional financing methods.

As the cryptocurrency landscape continues to evolve, MicroStrategy’s proactive approach to integrating bitcoin into its corporate treasury sets a precedent for other companies to explore similar opportunities. With a robust foundation of bitcoin holdings and a strategic roadmap for future growth, MicroStrategy is well-positioned to navigate the complexities of the digital asset market and capitalize on emerging opportunities.

In conclusion, MicroStrategy’s plan to issue $700 million convertible notes represents a strategic move to optimize its financial position, expand its bitcoin holdings, and reinforce its leadership in the cryptocurrency space. By leveraging debt to acquire more bitcoin, MicroStrategy is poised to capitalize on the potential growth of the digital asset market and drive long-term value for its shareholders.