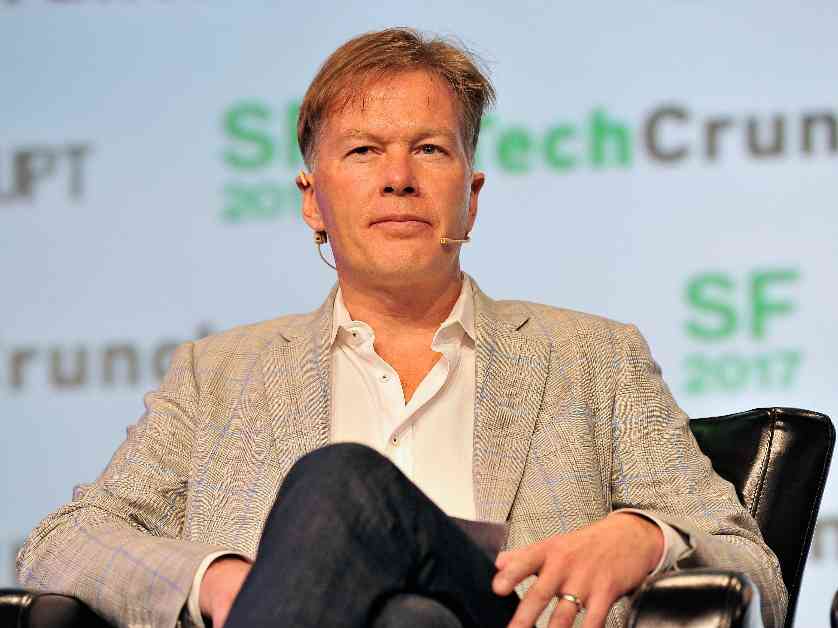

Dan Morehead’s Pantera Capital Management has made a significant profit on its Bitcoin investment. The hedge fund has achieved a remarkable 1,000-fold gain in the value of its crypto holdings since its inception in 2013. This makes Pantera Capital one of the first funds to venture into Bitcoin investing.

The Bitcoin Fund, established in 2013, has seen a return of 131,165% after expenses and fees. The surge in the fund’s value was particularly notable after Donald Trump’s election as U.S. president. Morehead, the founder of Pantera Capital, made a bold decision to invest in Bitcoin early on, purchasing 2% of the world’s Bitcoin supply when the price was around $74.

Bitcoin’s price has soared over 120% in the past year, reaching a new all-time high close to $100,000. Morehead expressed his optimism about future growth, predicting that Bitcoin could reach $740,000 by April 2028. This would result in a $15 trillion market capitalization, considering that a significant portion of financial wealth has yet to embrace blockchain technology.

Institutional managers like BlackRock and Fidelity have played a key role in making Bitcoin and Ethereum more accessible to investors. They have launched spot Bitcoin and Ether exchange-traded funds, allowing tens of millions of clients to gain exposure to the crypto industry. Morehead also highlighted the shift in regulatory attitudes towards blockchain, with the upcoming U.S. administration expected to be more supportive of the technology.

Helene Braun, a news reporter at CoinDesk, covers developments related to Wall Street, Bitcoin ETFs, and crypto exchanges. She is a graduate of New York University’s business and economic reporting program and has made appearances on major news platforms. Braun holds Bitcoin and Ethereum in her portfolio, reflecting her confidence in the future of cryptocurrencies.