Donald Trump’s administration is expected to create a more favorable environment for cryptocurrencies, with the possible adoption of the Bitcoin Act being a key development. According to a report by asset manager CoinShares, passing the Bitcoin Act would be a significant boost for the industry. The bill aims to establish bitcoin as a strategic reserve asset, with the U.S. government potentially acquiring up to 5% of bitcoin’s total supply. This move would give bitcoin a status similar to that of gold and increase its legitimacy.

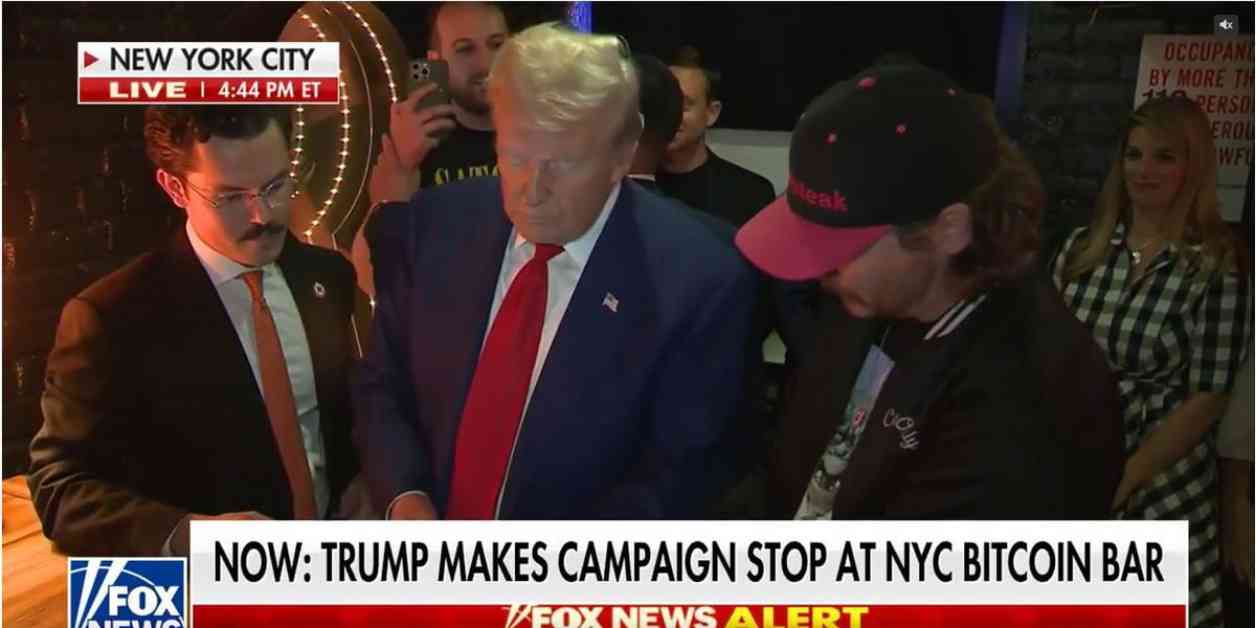

The introduction of the Boosting Innovation, Technology and Competitiveness Through Optimized Investment Nationwide (BITCOIN) Act by U.S. Sen. Cynthia Lummis (R-Wyo.) earlier this year underscores the growing interest in bitcoin at the governmental level. The bill proposes the establishment of a strategic bitcoin reserve to help reduce the national debt by purchasing 1 million BTC over five years. President-elect Trump has also expressed support for the idea of a bitcoin reserve, promising to implement it if elected.

If the Bitcoin Act is enacted, it could lead to a surge in institutional and governmental interest in bitcoin. This heightened attention could accelerate the growth of the cryptocurrency and drive its value to new highs, according to CoinShares. Additionally, changes in SEC leadership under the Trump administration could result in a more crypto-friendly regulatory environment, further boosting the industry.

Broker Canaccord highlighted the potential impact of regulatory changes on the mainstream financial services industry. A more favorable stance from the SEC, along with the implementation of a regulatory framework for the crypto industry, could pave the way for wider adoption of digital assets by traditional financial institutions. Companies like Coinbase and Galaxy Digital stand to benefit from these developments, as they would operate in a more supportive regulatory environment.

In conclusion, the adoption of the Bitcoin Act and changes in SEC leadership could usher in a new era of growth and acceptance for the cryptocurrency industry. With the backing of the U.S. government and a more favorable regulatory landscape, bitcoin and other digital assets could see increased adoption and value appreciation in the coming years. The potential impact of these changes extends beyond the cryptocurrency market, reaching into the broader financial sector and signaling a shift towards mainstream acceptance of digital assets.