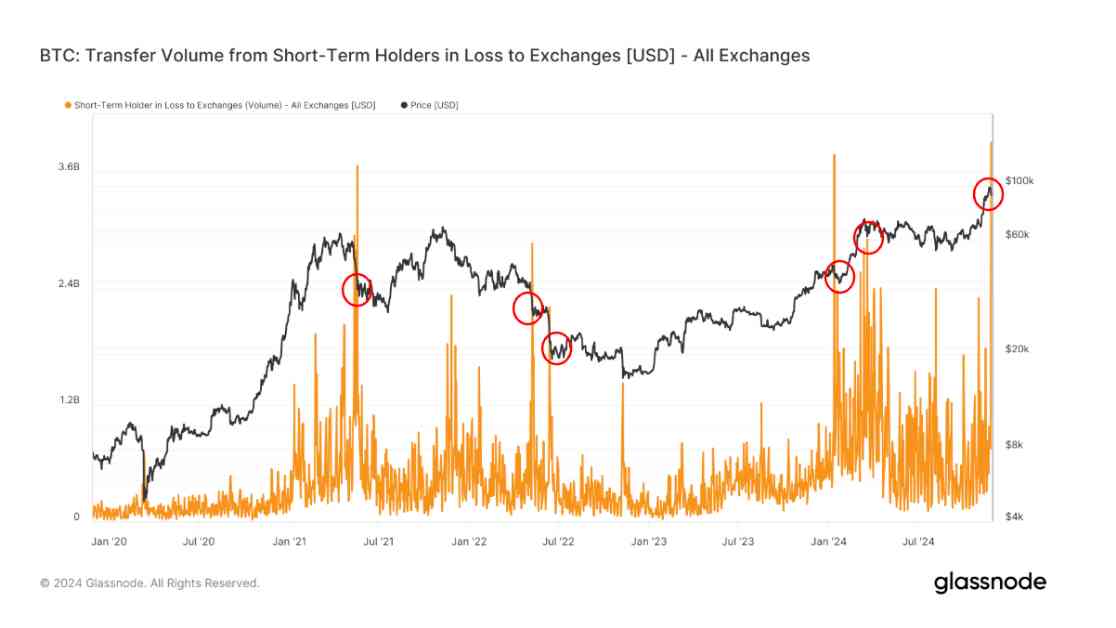

Bitcoin has been experiencing a lot of volatility recently, with the price dropping from nearly $100,000 to almost $90,000 in a 10% correction. This has led to short-term holders, those who have held bitcoin for less than 155 days, moving a significant amount of BTC to exchanges at a loss. According to Glassnode data, these holders have sent $7.8 billion or 83,000 BTC to exchanges over the past two days, marking a record high in notional terms. When this group sends $2 billion or more worth of tokens to exchanges at a loss, it usually indicates a local bottom for the price of bitcoin.

As of now, investors who bought bitcoin in the past week are the only ones currently at a loss, with approximately 678,000 bitcoin sitting in a loss according to Glassnode data. This comes after a period of record profit-taking as bitcoin approached $100,000. The recent movement of BTC to exchanges by short-term holders signals a potential local bottom for the price of bitcoin, giving investors a glimpse of what may come next.

James Van Straten, a senior analyst at CoinDesk, specializing in Bitcoin and the macro environment, believes that the current cycle of bitcoin has been relatively subdued in terms of volatility and drawdowns compared to previous cycles. As an expert in on-chain analytics, James closely monitors ETFs, spot and futures volumes, and flows to gain a deeper understanding of how bitcoin interacts within the financial system. With a diverse investment portfolio including bitcoin, MicroStrategy, Semler Scientific, and other companies in the crypto space, James provides valuable insights into the current state of the market.

Overall, the recent movement of bitcoin to exchanges by short-term holders indicates a potential local bottom for the price of bitcoin. As investors navigate the volatility of the market, it is important to stay informed and make educated decisions based on expert analysis and data-driven insights like those provided by James Van Straten.