Dealers are utilizing various approaches to ascertain if Bitcoin’s cost has bottomed, but on-chain action and derivatives info indication that the situation remains precarious.

Dealers are using a variety of approaches to ascertain if Bitcoin’s cost has bottomed, but on-chain action and derivatives info indication that the situation remains precarious.

According to Twitter consumer Noshitcoins, derivatives and on-chain information indicate that additional downside can be in store.

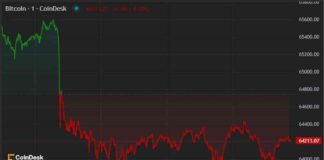

The movement culminated with $12 billion value of futures positions being liquidated, so far, dealer optimism stays somewhat dampened.

Nevertheless, two days after, Bitcoin was able to break the 40,000 level, even though the movement did not last for over six hours. Meanwhile, other dealers inferred a retest of their 30,000 underside is necessary in front of a bounce.

Even though there might be empirical proof or logic financing those statements, market prices do not necessarily react to outside information or preceding chart formations. Unlike shares, Bitcoin investors can not rely on commonly used valuation multiples or perhaps comparables.

Sure, an electronic store of value will be 1 use case, but in precisely the exact same time, it’s uncensorable and readily transferable. What’s more, some users appreciate Bitcoin’s peer reviewed fiat convertibility out Know Your Customer-regulated exchanges. One more factor to consider is that the investors that are raising their Bitcoin portfolio as a result of absence of correlation with conventional financial resources.

This panacea of varied and sometimes conflicting narratives creates obstacles for mimicking the market’s possible, adoption status as well as measuring the efficacy of recent advancements.

Skew: The specialist”fear and greed” index

Call choices permit the purchaser to obtain Bitcoin in a fixed price once the contract expires.

If market manufacturers and specialist dealers lean bullish, they’ll require a greater premium on telephone (purchase ) options. This trend will lead to a negative 25 percent delta skew index. On the flip side, if disadvantage protection is significantly more expensive, the skew indicator will end up positive.

A 25 percent delta skew oscillating between a negative 10% plus a favorable 10 percent is generally deemed impartial.

Since the markets dropped, so did the 25 percent delta skew index, and the price of protective alternatives spiked. As a result, before the metric determines a more impartial pattern closer to the 5 percent level, it appears premature to predict the industry .

Lively Bitcoin supply signs that feeble hands Will Need to cool off

Dealers also track the amount of BTC which has been busy recently. This index can not be deemed bullish or bearish alone, as it doesn’t offer advice on how outdated the addresses that are involved are.

The 500% cost rally in Oct. 1, 2020, and also the $64,900 summit on April 14, 2021, caused a significant gain in the supply moved in the months prior to the rally. If this metric introduces a sharp reduction, it suggests that traders are no more interested in engaging in the present price level.

There are now 2.2 million BTC active within the previous 30 days, and it is considerably higher than levels seen before October 2020.

As things now stand, traders shouldn’t be so Bitcoin has bottomed, at least before the industry no longer has related activity surrounding the sub-$40,000 degree.