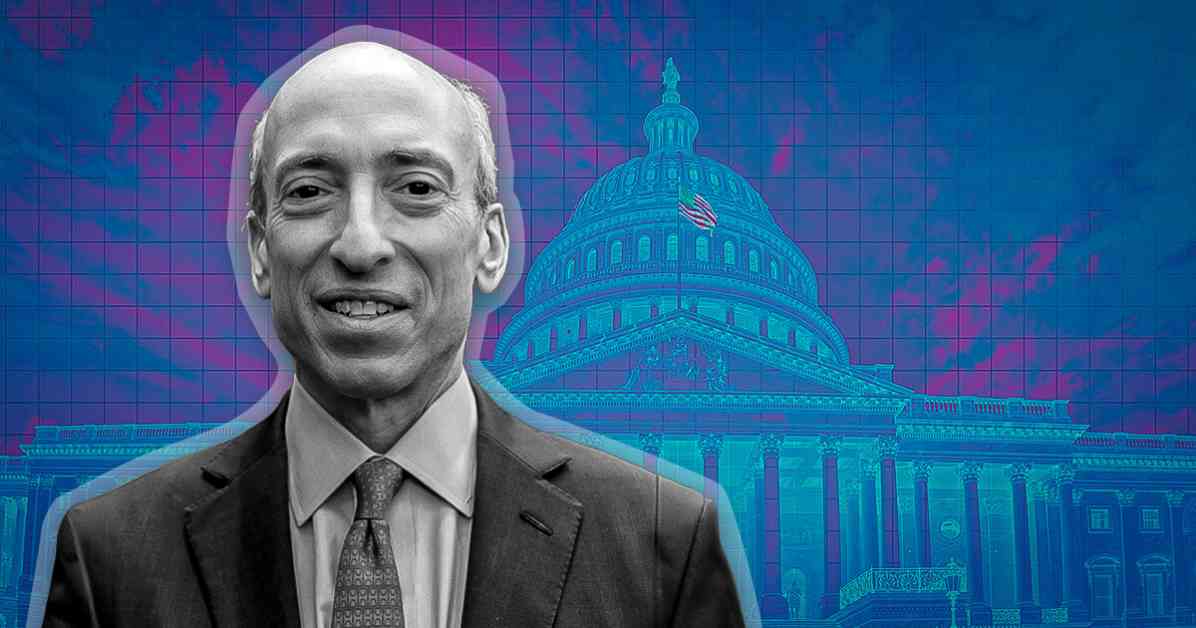

Former Olympic rower and crypto exchange Gemini co-founder Tyler Winklevoss has strong opinions about SEC Chair Gary Gensler’s recent actions. In a post on X, Winklevoss expressed his belief that Gensler’s behavior cannot be dismissed as mere “good faith mistakes.” Instead, he argues that Gensler’s actions were deliberate, calculated, and intended to serve his personal and political agenda, regardless of the consequences.

Winklevoss went on to describe Gensler as “evil,” emphasizing that the SEC Chair showed a blatant disregard for the impact of his decisions on the crypto industry, jobs, livelihoods, and investments. According to Winklevoss, Gensler’s actions have caused irreparable harm that no amount of apology can undo.

Expressing frustration, Winklevoss stated that Americans are tired of their tax dollars being used by politicians to advance their own careers rather than protect the people. He firmly believes that Gensler should never hold a position of influence or power in any institution, big or small, in the future. Winklevoss even went as far as to suggest that any organization that associates with Gensler after his time at the SEC should be boycotted for betraying the crypto industry.

Winklevoss’s criticism of Gensler is part of a larger trend of accusations against the SEC for abusing its powers. Recently, 18 U.S. states filed a lawsuit against both the SEC and Gensler, citing “gross government overreach.” Even Republican President-elect Donald Trump, during his campaign, promised to remove Gensler from his position on his first day back in the White House.

Although the President does not have the authority to directly fire the SEC Chair, Gensler’s term is set to end in July 2025. Trump’s transition team is reportedly preparing a list of potential replacements for key financial agency positions, including the SEC Chair. Among the contenders are Dan Gallagher, Paul Atkins, and Robert Stebbins, with Gallagher being considered the frontrunner at the moment.

In conclusion, Winklevoss’s criticisms of Gensler’s actions highlight the growing concerns about government overreach and misuse of power. The ongoing debate surrounding the SEC Chair’s conduct underscores the need for accountability, transparency, and ethical leadership in regulatory agencies.