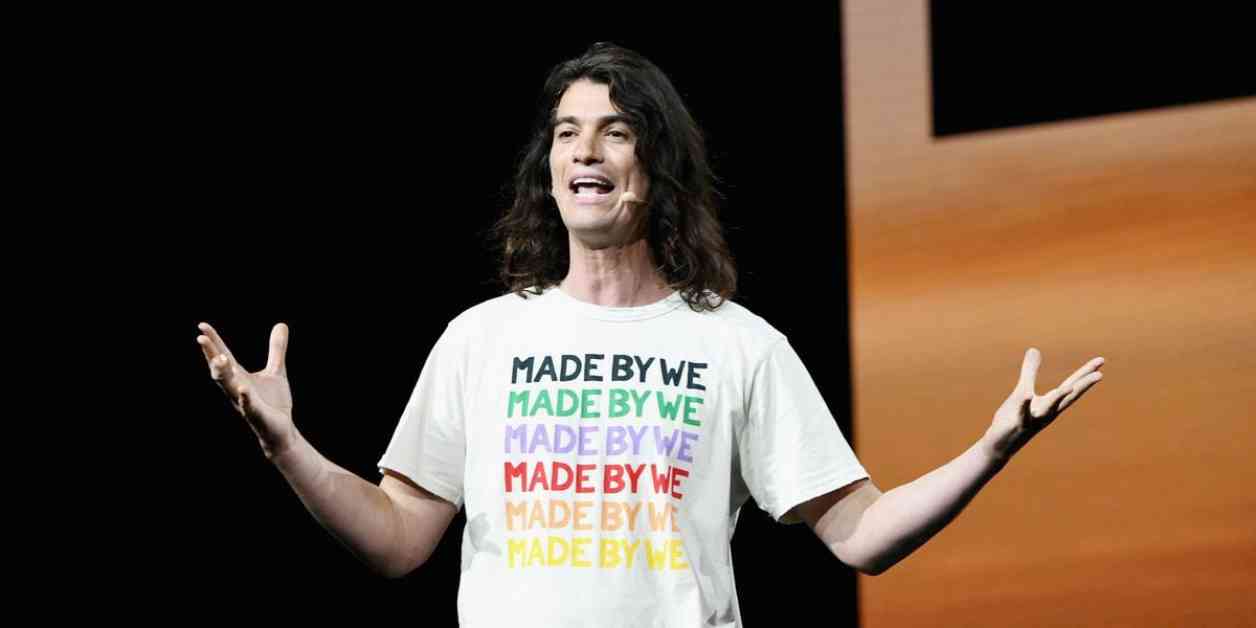

Flowcarbon, a climate company co-founded by WeWork’s Adam Neumann, is making headlines after offering refunds to holders of its native crypto token, the “Goddess Nature Token.” This move comes after the token failed to launch as planned, according to a report by Forbes.

The startup, which was established in 2022, raised a substantial $70 million from investors such as Andreessen Horowitz. The primary goal of Flowcarbon was to tokenize carbon credits by incorporating them into the blockchain. The company had ambitious plans to create a token backed 1:1 by carbon credits, aiming to revolutionize the traditional carbon credit market.

Carbon credits play a crucial role in reducing greenhouse gas emissions by allowing their owners to offset a specific amount of emissions. Each credit represents one metric ton of carbon dioxide removed from the atmosphere. While carbon credits are typically purchased directly from project owners or brokers, Flowcarbon intended to sell them as crypto tokens, introducing a new digital approach to the market.

Out of the $70 million raised for Flowcarbon, a significant portion, at least $38 million, was generated through the sale of the Goddess Nature Token (GNT). However, the company has now decided to refund token holders due to various reasons, including market conditions and resistance from carbon registries. People familiar with the matter revealed to Forbes that Flowcarbon has been reaching out to GNT holders to issue refunds.

In a statement to Forbes, Flowcarbon acknowledged the challenges they have faced, stating, “It’s well known that since last year we have been offering refunds to retail GNT buyers due to the industry delays, with standard and customary terms, as we continue to grow Flowcarbon as a leader in carbon finance.” This decision reflects the company’s commitment to transparency and accountability amidst the evolving landscape of carbon finance.

CEO Dana Gibber previously told the Wall Street Journal in July 2022 that the company had opted to pause the launch of the token to allow markets to stabilize. This decision followed a turbulent period in the crypto market, triggered by events such as the FTX fallout. Additionally, prominent carbon credit registry Verra cautioned against tokenizing credits that are typically retired after purchase, adding further complexity to Flowcarbon’s operations.

As countries worldwide strive to achieve carbon neutrality, the traditional carbon credit market has emerged as a lucrative investment opportunity. In 2022, the market was valued at over $330 billion, attracting investors seeking sustainable and profitable ventures. The concept of tokenization, which involves digitizing carbon credits on the blockchain, was intended to enhance market transparency and accessibility for investors.

Recently, projects like Neutral and DLT Finance have made strides in tokenized trading platforms for carbon credits. Neutral, in collaboration with DLT Finance, launched a regulated blockchain-backed platform where investors can trade carbon credits seamlessly. These initiatives highlight the growing interest in leveraging blockchain technology to innovate and streamline the carbon credit market.

Overall, the refund offer extended by Flowcarbon underscores the challenges and complexities inherent in merging traditional finance with emerging technologies like blockchain and cryptocurrencies. While the Goddess Nature Token may not have met expectations, the company’s commitment to addressing market conditions and prioritizing investor interests is commendable. As the climate finance sector continues to evolve, collaborations and innovations will be key in driving sustainable solutions for a greener future.