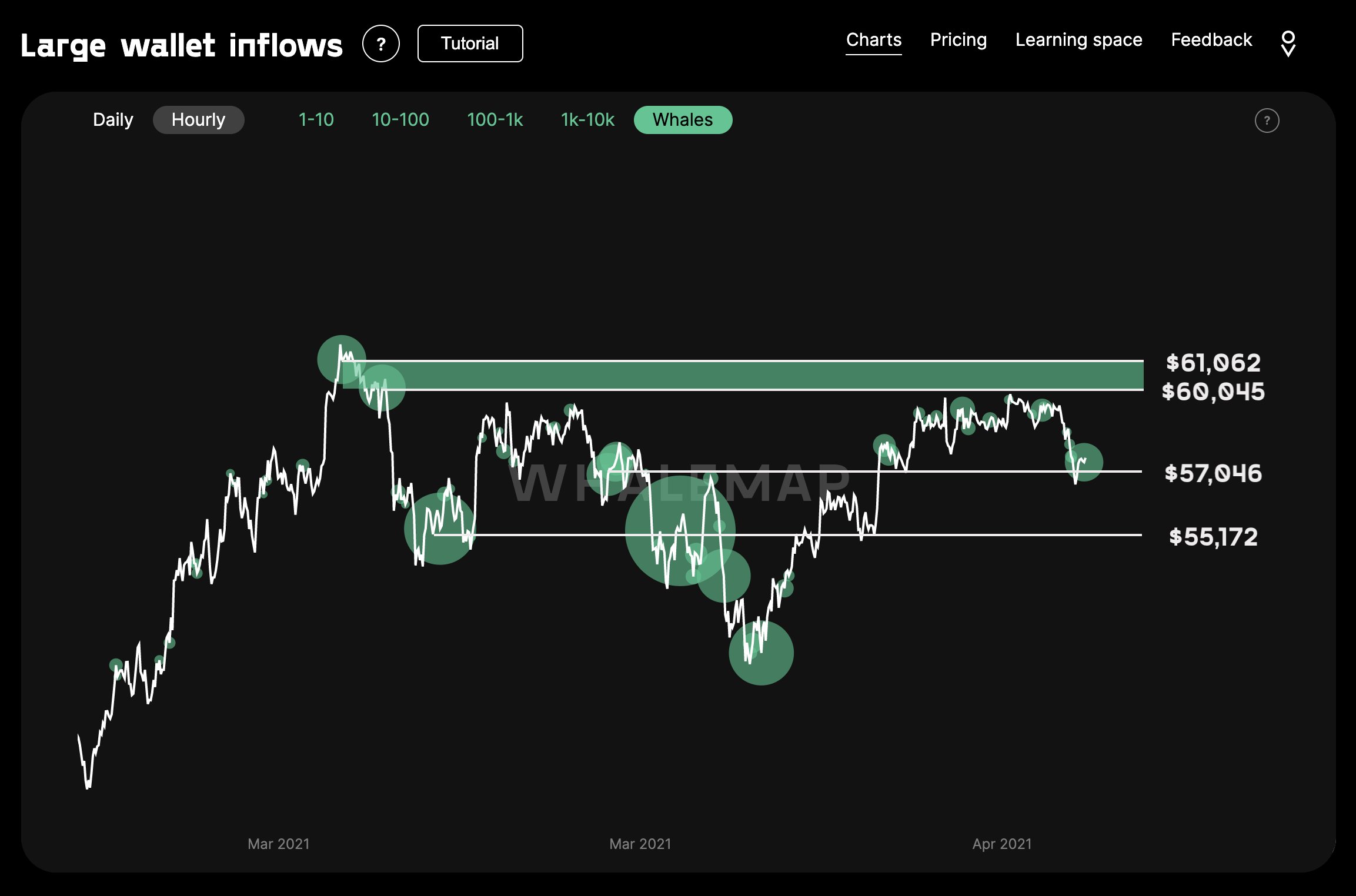

Bitcoin whale figures reveal $57,046 and $60,045 will be the vital resistance and support levels in the brief term.

The cost of Bitcoin (BTC) is trying to break the 60,000 immunity level after over a week of that range.

Whale figures demonstrate that the $57,046 and $60,045 will be the vital resistance and support areas in the brief term.

To put it differently, the likelihood of a powerful breakout in the near future could rise substantially if Bitcoin remains above $57,046 and proceeds to check 60,000 resistance.

Why whale clusters are significant for Bitcoin

Whale clusters form if high-net-worth investors purchase or sell Bitcoin in a particular cost and don’t transfer their holdings afterwards.

Therefore, a whale audience support typically functions as a powerful macro service area for Bitcoin since whales have a tendency to purchase more when BTC drops to a level in which they originally bought BTC.

On the reverse side, a whale audience immunity area would probably hold up as a market area because whales are more inclined to wait till their breakeven cost to market their rankings.

Bouncing perfectly from whale affirms up to now. This is a great hint: in bear tendencies, whale resistances work better compared to affirms and vice versa for bull tendencies. Whale supports return to business today so the trend has changed. April ought to be quite enjoyable.”

Ever since that time, the purchase price of Bitcoin has already been ranging and consolidating between the immunity level and the $57,000 support.

They wrote:

“The service immunity battle is extreme. Amounts from last week are still functioning fairly well. Bitcoin has been capped by the 60,045 level fairly spot on.

Dealers’ opinion about Bitcoin is blended

As stated by the pseudonymous dealer called Byzantine General, the Bitcoin futures market is growing extremely overheated.

The derivatives market is slumping while the BTC futures capital rate is always spiking above 0.12 percent.

The dealer stated :

“This seems pretty poor tbh. A fantastic flush could be a boon.”

A dealer called NekoZ said that the technical marketplace arrangement of Bitcoin about the 4-hour chart suggests that BTC could consolidate more, but he isn’t bearish in the long run.

The dealer stated :

2 points I’m adding to my entire long. Provided that we maintain revealing greater highs, 0 rationale to worry.”

Dealers generally echo the opinion that Bitcoin could observe a little pullback to reset from the overheating derivatives marketplace, but the macro technical arrangement stays optimistic.