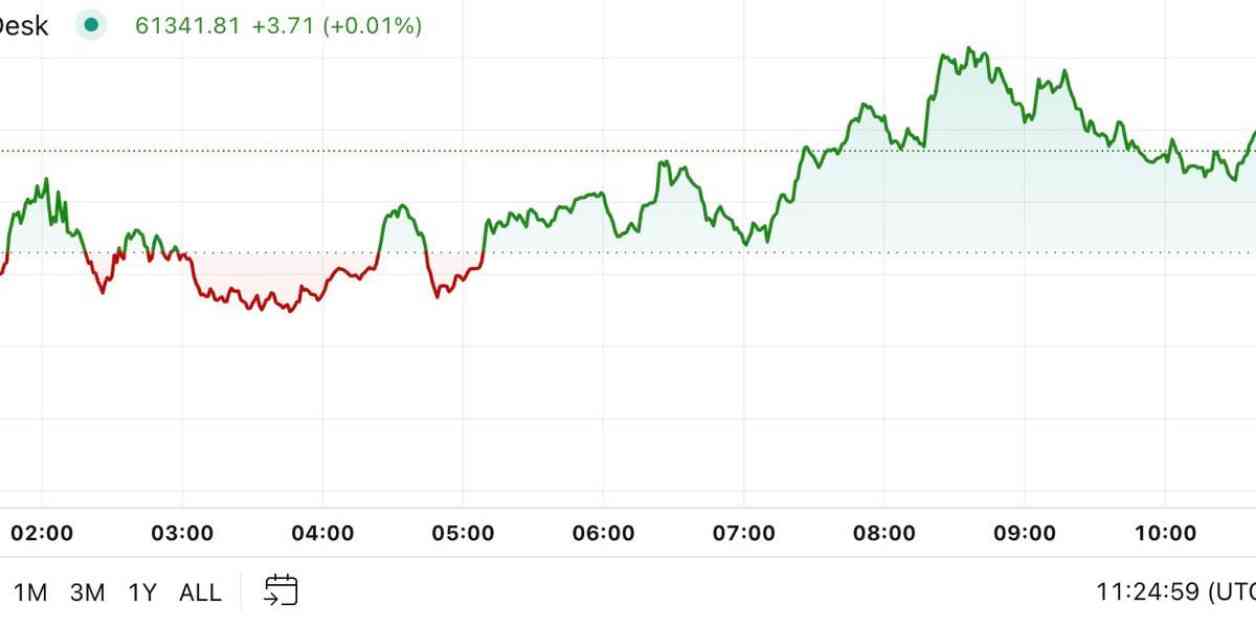

Bitcoin’s price has been making headlines once again, bouncing back from a brief dip below $60,000 to trade around $61,300 during the European morning. While the cryptocurrency market as a whole has seen a 1.15% increase, BTC itself is down around 6% since the start of October. Despite October being historically bullish for Bitcoin, data shows that the majority of gains typically occur in the second half of the month. This year, geopolitical tensions and the upcoming U.S. presidential election are also impacting market sentiment, with investors turning towards assets like oil and gold.

JPMorgan analysts have pointed out that the current environment favors the ‘debasement trade,’ which benefits both bitcoin and gold. A potential Trump win in the election could further support this trade, leading to higher U.S. Treasury yields, a stronger dollar, and outperformance in the stock market. However, these shifts have not yet materialized, with only minor movements seen in these markets so far.

Looking at the chart of bitcoin’s yen-denominated prices, there are indications of renewed bullish momentum following a rebound from previous highs. The long tails on the candles suggest that sellers may be exhausted, potentially paving the way for further price increases in the near future.

In conclusion, while Bitcoin’s price may have experienced some fluctuations in recent days, the overall outlook remains positive. Investors will be keeping a close eye on geopolitical developments and the election outcome to gauge the potential impact on the cryptocurrency market. As always, it’s important to stay informed and make decisions based on a thorough understanding of the market dynamics.