The US government recently faced a cybersecurity breach where nearly $19.3 million in crypto funds were stolen from government-associated wallets. However, the hacker responsible for the theft surprisingly returned almost 88% of the stolen assets within 24 hours, totaling $17 million. This quick recovery has left experts questioning the security protocols in place for government-controlled digital assets.

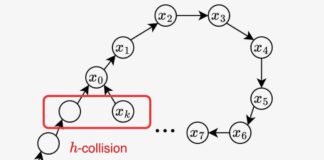

The stolen funds, consisting mostly of stablecoins and ether, were transferred through suspicious addresses connected to a known money-laundering service. The breach occurred shortly after a report from Arkham Intelligence regarding unusual activity in dormant addresses related to the Bitfinex hack. By the next morning, most of the assets were back in government possession.

Despite the successful recovery, concerns have been raised about the security of state-controlled digital assets. Analysts have pointed out potential security gaps and inconsistencies in wallet management, highlighting the need for more robust security measures. The motives behind the theft and subsequent return of the funds remain unclear, adding a layer of mystery to the incident.

This breach is just one in a series of recent cybersecurity incidents involving US government entities, including the hacking of the Securities and Exchange Commission’s social media accounts. While the hacker responsible for that breach has been caught, it has still raised alarms about the overall cybersecurity practices within federal agencies.

As experts and analysts continue to monitor the situation for more information, the incident serves as a reminder of the vulnerabilities in managing digital assets tied to criminal activities. It also sparks discussions about the importance of transparent and stringent security practices for government crypto asset management.

Overall, this incident highlights the ongoing challenges faced by state agencies in safeguarding their digital assets and the urgent need for improved custodial crypto storage practices to prevent future breaches.