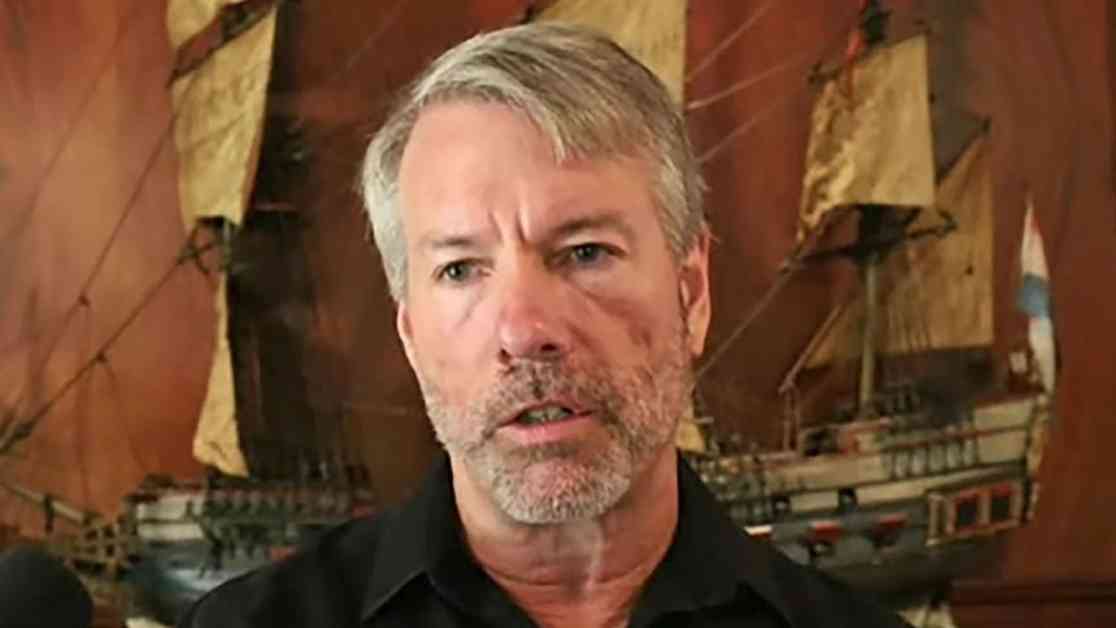

MicroStrategy, a software company founded by Michael Saylor, has been highlighted as a top way for equity investors to get exposure to bitcoin (BTC), according to a recent report by broker Canaccord. The report praised MicroStrategy’s intelligent leverage strategy and raised its price target for the company to $300 from $173, while maintaining a buy rating on the shares.

The analysts at Canaccord emphasized that MicroStrategy has been performing exceptionally well since adopting its bitcoin acquisition strategy in 2020, outperforming both equities and the world’s largest cryptocurrency. The company recently announced a $21 billion at-the-money offering of its own stock to raise funds for buying more bitcoin, with plans to acquire another $42 billion worth of the crypto in the next three years.

With this leverage strategy in place, Canaccord sees the potential for additional premium to spot to re-emerge in MicroStrategy shares. The broker is also optimistic about the future of bitcoin, citing the approval of spot exchange-traded funds (ETFs) in the U.S. and supply constraints following the halving event earlier this year as factors that could drive the cryptocurrency higher.

In light of these developments, bitcoin broke the $64,000 mark while gold prices surged. Additionally, the ETH/BTC ratio slid to its lowest level since April 2021, prompting questions about whether bitcoin is losing its bullish momentum.

It is evident that MicroStrategy’s strategic approach to investing in bitcoin has caught the attention of investors and analysts alike. As the cryptocurrency market continues to evolve, the company’s bold moves and commitment to expanding its bitcoin holdings are positioning it as a key player in the digital asset space.

As always, investors are advised to conduct their own research and consider their risk tolerance before making any investment decisions. With the cryptocurrency landscape constantly changing, staying informed and updated on the latest developments is crucial for navigating this volatile market.