US Markets and Bitcoin Rally Ahead of Elections: What to Expect

As the US presidential election draws near, experts like Tom Lee from Fundstrat Global Advisors and analysts from Bernstein are optimistic about the future of US markets and Bitcoin, regardless of the election outcome.

Tom Lee, the managing partner at Fundstrat, recently appeared on CNBC to share his insights on the market. He believes that the economic fundamentals are strong, and with a dovish position from the Federal Reserve, there is a high possibility of a year-end rally. Lee pointed out that the uncertainty surrounding the election has caused many investors to hold onto cash, but once the results are clear, this sidelined cash could flow back into the market. He remains bullish on the market, citing strong earnings reports and Fed support as key drivers for market performance in 2025 and beyond.

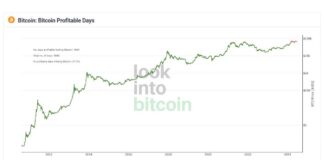

On the other hand, Bernstein analysts are focusing on Bitcoin’s resilience amid political uncertainty. They believe that Bitcoin is well-positioned to withstand political shifts due to factors such as US fiscal policy, record debt levels, and the increasing demand for hard assets. Bernstein has set a price target of $200,000 for Bitcoin by 2025, anticipating its growth potential in an environment of fiscal indiscipline and monetary expansion. The recent adoption of Bitcoin ETFs, which brought in over $23 billion in year-to-date inflows, is expected to further boost Bitcoin’s momentum, regardless of the election outcome.

In terms of the election impact on Bitcoin, Bernstein analysts foresee different scenarios depending on the winner. A Trump victory could potentially drive Bitcoin to new highs of $80,000 to $90,000, while a Harris win might lead to a temporary dip near $50,000. They noted that Trump’s perceived pro-crypto stance contrasts with Harris’s reported hawkish position, which could influence Bitcoin’s price movement in the short term.

Overall, both Tom Lee and Bernstein are optimistic about the US markets and Bitcoin, highlighting the potential for growth and resilience in the face of political uncertainty. With favorable economic fundamentals and structural drivers supporting Bitcoin’s long-term growth, investors can expect a positive outlook for both markets in the coming years.