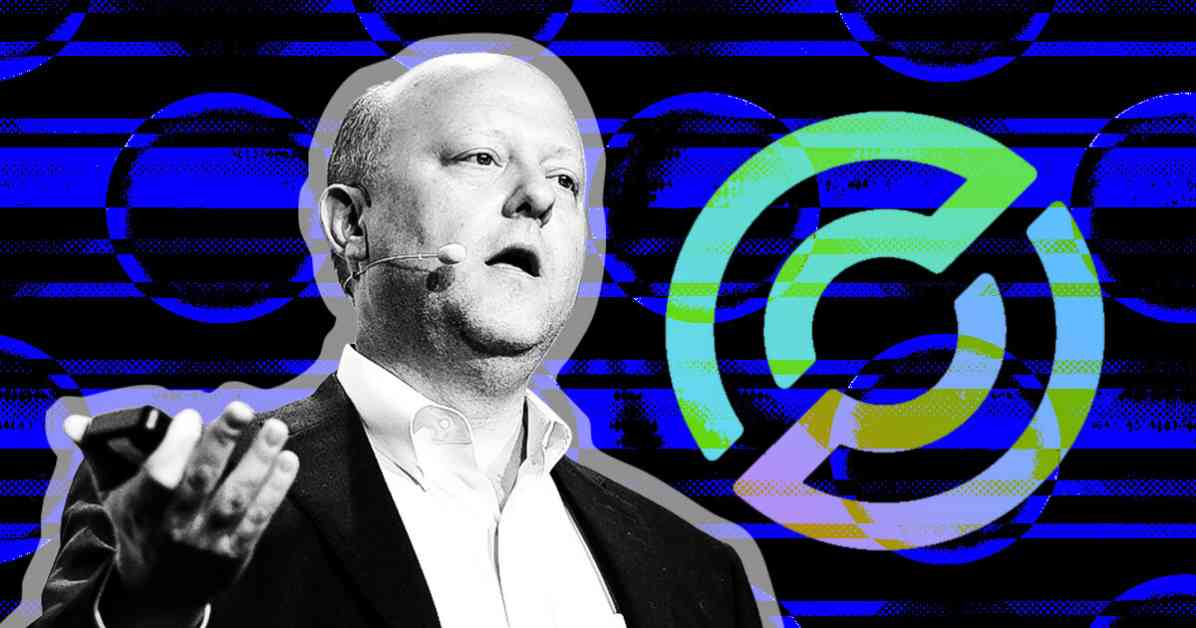

Circle CEO Jeremy Allaire believes that stablecoins have the potential to revolutionize global trade and enhance efficiency in emerging markets. Speaking at the Hong Kong FinTech Week 2024, Allaire emphasized the role of stablecoins, particularly USDC, in modernizing trade settlements and making financial transactions faster and more cost-effective.

He pointed out that many importers in developing regions already rely on Hong Kong for trade settlements, making the city a crucial testing ground for stablecoin solutions. Allaire stated that stablecoins are reshaping financial infrastructure by facilitating trade settlements that reduce friction and costs.

During the event, Circle announced partnerships with Hong Kong Telecom (HKT) to explore blockchain-based loyalty programs and with Thunes to use USDC for cross-border transactions. These partnerships demonstrate Circle’s commitment to leveraging stablecoins for practical applications in trade and commerce.

While this year’s FinTech Week focused on artificial intelligence and tokenization, stablecoins and central bank digital currencies (CBDCs) emerged as key themes shaping Hong Kong’s Web3 strategy. With the Hong Kong Monetary Authority planning to issue new stablecoin regulations by the end of the year, Circle is prepared to comply with regulatory frameworks globally.

Allaire highlighted Hong Kong’s role as a global trade hub, making it an ideal environment for stablecoin adoption. However, he acknowledged that Circle’s operations would be limited in mainland China due to strict regulations on commercial crypto activities. He predicted a thriving “offshore stablecoin” market to support seamless currency exchange and enhance cross-border transaction efficiencies.

Allaire also suggested that the entry of major technology firms like Ant Group or Tencent Holdings into the stablecoin market could further drive stablecoin adoption. He believes that a broader stablecoin ecosystem involving these companies would support global financial infrastructure and meet the demands of modern trade and digital economies.

Overall, Circle’s CEO sees stablecoins as the linchpin for global trade stability, paving the way for more efficient and cost-effective cross-border transactions in the future.