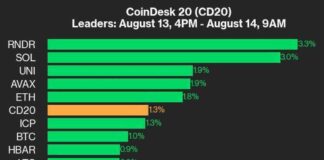

Yesterday, there was a significant shift in the investment landscape as Donald Trump was re-elected as the President of the United States. This news led to a broad-based rally in risk assets on Wall Street. Major indexes such as the S&P 500 and Nasdaq Composite, as well as cryptocurrencies, experienced a surge in value.

One of the contributing factors to these gains was the lack of investment exposure for momentum-based hedge funds. Institutional investors with short-term orientations reduced their risk exposure due to the uncertainty surrounding the election outcome. This move was aimed at safeguarding their performance towards the end of the year.

However, there are more substantial reasons behind the rally. During Trump’s previous term, he advocated for less government intervention and regulation, favoring a more free-market approach. This stance is expected to continue, resulting in reduced oversight and investigations for industries like technology. Additionally, Trump’s support for a weaker dollar to boost domestic economic growth is likely to lead to lower borrowing costs through a drop in the federal funds rate.

Based on historical observations and economic indicators, it is anticipated that the Federal Reserve will cut interest rates to stimulate economic growth. Factors such as employment data, inflation growth, and economic output have returned to pre-pandemic levels, signaling the need for a more accommodative monetary policy.

Looking at the employment figures, recent data showed a modest increase in jobs added, aligning with the average monthly gains seen before the pandemic. Similarly, inflation growth has eased back to pre-pandemic levels as stimulus-driven spending subsides. Economic output has also shown a steady pace of growth throughout the year, pointing towards a more stable economic environment.

Considering these factors, it is expected that the Federal Reserve will implement rate cuts to support economic growth. This move is likely to provide a boost to dollar-based risk assets such as cryptocurrencies like bitcoin and ether. As borrowing costs decrease, individuals and businesses will have easier access to funds, leading to increased spending and overall economic expansion.

In conclusion, the re-election of Donald Trump has set the stage for a shift towards a more market-driven approach in the economy. With the Federal Reserve expected to lower interest rates, investors can anticipate a favorable environment for risk assets like cryptocurrencies. By analyzing economic indicators and historical trends, we can gain insights into the potential outcomes of monetary policy decisions and their impact on the financial markets.