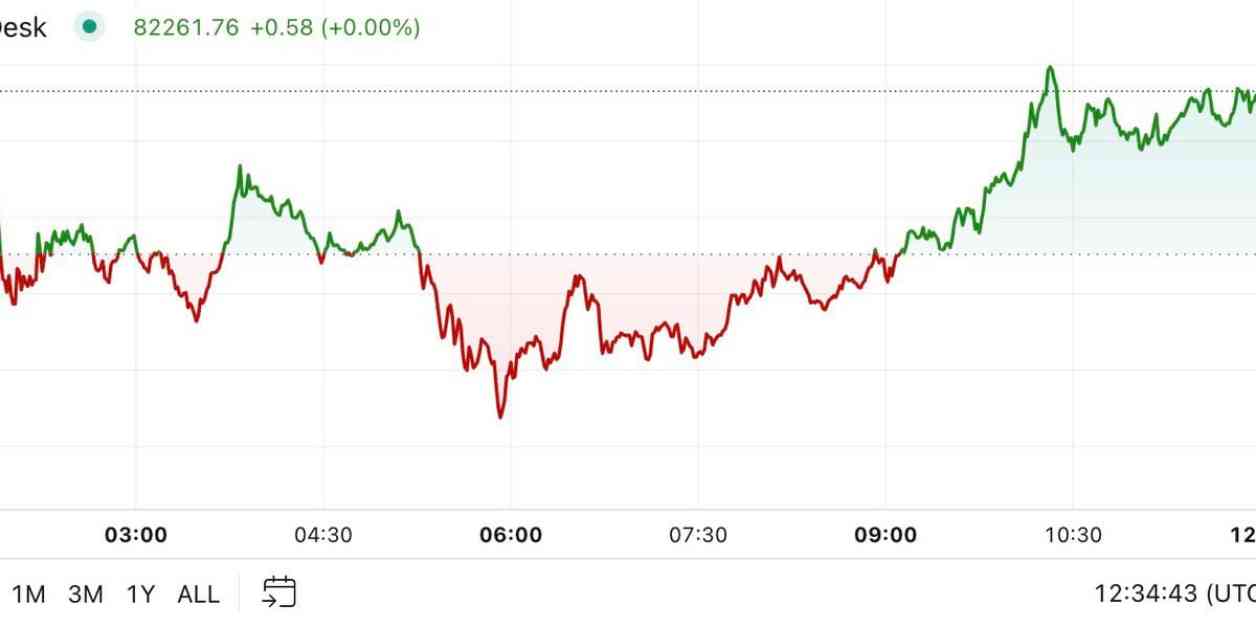

Bitcoin surged over the weekend, reaching a record high of $82,000 on Monday. This spike in price came after a busy weekend for BTC, with a 4% increase and trading volumes nearing $100 billion. These weekend pumps are viewed as positive signs in the crypto market, especially since professional traders and institutional investors are typically less active during weekends. The momentum continued into the new week, with Bitcoin peaking at $82,394. Futures premiums on BTC-tracked products are on the rise, indicating a preference for bullish bets. The $80,000 call on Deribit is gaining popularity, suggesting potential dealer hedging around this key level.

Amidst the Bitcoin rally, Dogecoin and shiba inu experienced significant gains, with price increases of 22% and 12% respectively. Dogecoin even surpassed XRP and USDC to become the sixth-largest token by market cap. The surge in DOGE can be attributed to renewed endorsements by Elon Musk, which has boosted its price by 88% in the last 30 days. Additionally, over the weekend, ether crossed the $3,000 mark for the first time since early August, signaling a potential breakout from its price range. SOL also saw a boost, rising over 4.5% in the last 24 hours due to increased memecoin activity in its ecosystem.

In the U.S. market, crypto-related equities experienced significant gains during pre-market trading following Bitcoin’s rally. Companies like MicroStrategy, Semler Scientific, Coinbase, and Marathon Holdings all saw notable increases in their stock prices. MicroStrategy, which holds a substantial amount of bitcoin on its balance sheet, gained over 11% to reach just above $300 per share. The positive price action was also reflected in other mining companies like Riot Platforms, Iris Energy, and HIVE Digital Technologies, all of which saw double-digit increases.

The surge in Bitcoin price and the positive movement in the crypto market are indicative of growing investor confidence and interest in digital assets. As cryptocurrencies continue to gain mainstream adoption, we can expect to see more volatility and significant price movements in the market. Investors should remain cautious and stay informed about the latest developments in the crypto space to make well-informed investment decisions.