US Bitcoin ETFs currently hold a massive 1 million Bitcoin, with a total value of $96 billion. This staggering amount is close to surpassing the estimated 1.1 million BTC stash of Bitcoin’s mysterious creator, Satoshi Nakamoto.

According to Bloomberg ETF analysts, the US-traded spot Bitcoin exchange-traded funds collectively hold approximately 1.07 million BTC as of November 14. This amount is worth nearly $96 billion at the current prices. It was also reported that BlackRock’s iShares Bitcoin Trust (IBIT) has exceeded $40 billion in assets under management in just 211 days, placing it in the top 1% of all ETFs.

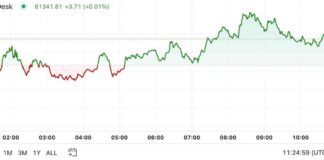

In terms of inflows, US-traded spot Bitcoin ETFs have seen around $2.4 billion come in this week alone. IBIT led the way with nearly $1.8 billion in inflows, making up almost 73% of the total amount. This week’s inflow surpasses last week’s $1.6 billion, assuming there are no significant outflows from the Bitcoin ETFs.

A recent report by Glassnode has highlighted a shift in investors’ behavior towards spot-driven exposure to Bitcoin through ETFs rather than futures contracts. This shift is attributed to the fact that the perpetual futures market premium peak on November 12 remained below March levels, indicating that spot buying pressure is the main driving force behind Bitcoin’s current surge to new highs.

There are predictions that investment giant Vanguard may soon begin offering spot Bitcoin and Ethereum ETFs on its brokerage platform. Despite Vanguard’s initial resistance to adding crypto products, experts believe that the firm will eventually give in next year, especially if Bitcoin maintains its current stability.

While some experts are confident in Vanguard’s eventual decision to offer crypto ETFs, others remain skeptical due to the firm’s size and previous reluctance. Regardless, the success of Bitcoin ETFs in the US market continues to attract attention and speculation from industry analysts and investors alike.