Bitcoin ETF investors have decided to cash in on their profits as a six-day winning streak comes to an end, resulting in a significant $400 million outflow across various ETFs on Nov. 14. However, amidst this trend, BlackRock’s ETF managed to stand out by attracting an inflow of $126.5 million, showcasing sustained interest from institutional players.

Other major funds such as Fidelity’s FBTC and Bitwise’s BITB saw outflows of $179.2 million and $113.9 million, respectively. Additionally, ETFs from Ark, Invesco, Franklin, Valkyrie, and VanEck also faced withdrawals, with Grayscale’s BTC product losing $69.6 million and GBTC dropping by $5.3 million. This resulted in a total outflow of $400.7 million for the day.

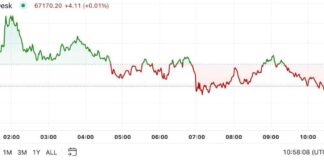

The shift in ETF flows seems to reflect investors locking in gains after a significant rally in Bitcoin’s price, which decreased by 3.12% to $88,091.43. Despite this decline, Bitcoin remains up 16.07% over the past week and 30.51% over the past month, with a market capitalization of $1.74 trillion and a 24-hour trading volume of $84.9 billion.

While Bitcoin is currently 6% below its recent all-time high of $93,311.31, the overall market sentiment remains cautiously optimistic. The market seems to be adjusting dynamically to rapid changes, with a mix of profit-taking and selective investment strategies being employed by investors.

This recent development in the ETF market highlights the varying approaches taken by investors in response to market movements. It also indicates that despite some profit-taking, there is still a strong interest from institutional players like BlackRock in Bitcoin and cryptocurrency investments.

Overall, the market’s response to the recent outflows and BlackRock’s inflow suggests a dynamic and evolving landscape in the cryptocurrency space, where investors are carefully navigating the ups and downs of the market to make strategic investment decisions.