Franklin Templeton has recently made a significant move by launching its OnChain U.S. Government Money Market Fund on the Ethereum blockchain. This allows the fund to be traded on Ethereum, which is currently the second largest blockchain by market cap.

The fund was already available on other blockchains such as Base, Aptos, and Avalanche, but adding Ethereum as a trading option opens up new possibilities for investors. Ethereum is a popular choice among issuers, handling over $1.6 billion worth of tokenized assets.

FOBXX, the OnChain U.S. Government Money Market Fund, was launched in 2021 and became the first money market fund to use a public blockchain to track transactions and ownership. With a market cap of $410 million, it is currently the third-largest tokenized money market fund.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) quickly rose to the top of the list just six weeks after its launch, reaching $545 million. The second largest fund, Ondo’s U.S. Dollar Yield (USDY), is at $452 million.

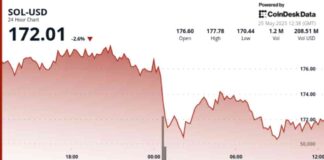

Ethereum is the preferred choice among issuers for issuing shares of tokenized treasuries, followed by Stellar (XLM) and Solana (SOL). Grayscale, an asset manager, has stated in a report that Ethereum is “meaningfully decentralized and credibly neutral for network participants,” making it a strong contender for a global platform for tokenized assets.

This move by Franklin Templeton to launch its money market fund on Ethereum reflects the growing trend of financial institutions embracing blockchain technology. It opens up new opportunities for investors and demonstrates the potential for blockchain to revolutionize traditional financial markets.

As the cryptocurrency industry continues to evolve, it is important for investors to stay informed about the latest developments and opportunities in the market. Keeping an eye on trends like tokenization on blockchain platforms can help investors make informed decisions and stay ahead of the curve.

Overall, this move by Franklin Templeton is a significant step towards integrating traditional finance with blockchain technology, marking a new chapter in the evolution of the financial industry.