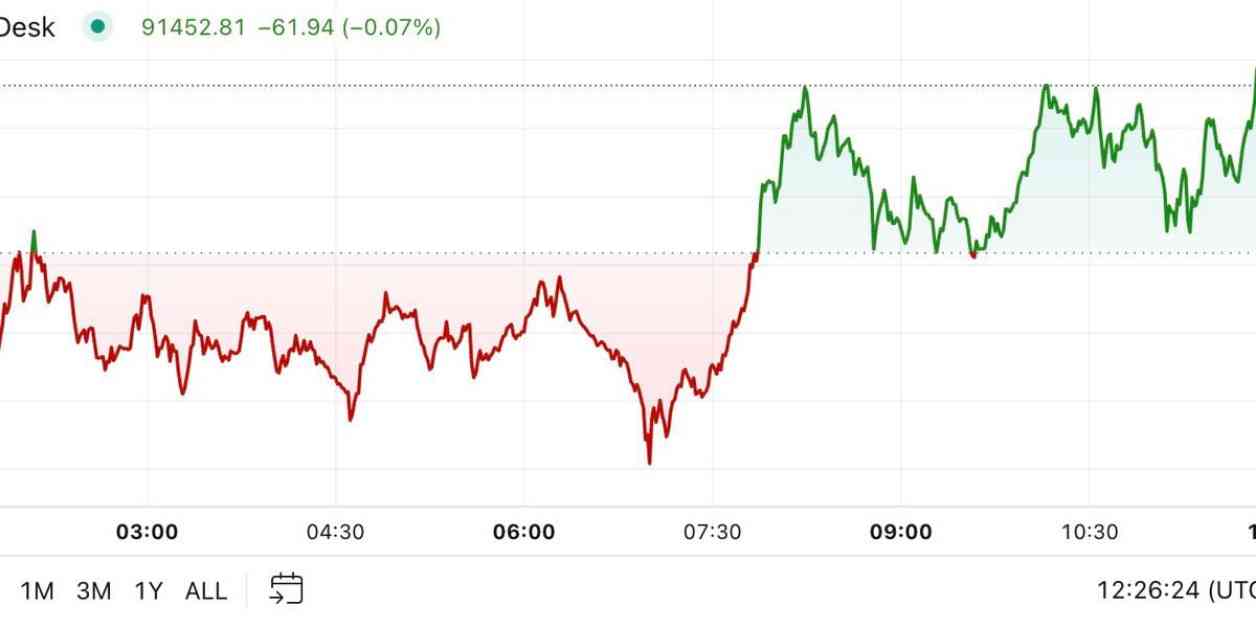

Bitcoin’s price has been fluctuating around $91,000, recovering from a slight dip to just above $89,000. Although it is currently 2% lower than its all-time high of $93,445, which was reached on Wednesday afternoon, it remains over 4% higher in the last 24 hours. The influx of Bitcoin ETFs saw an additional $510 million in inflows on Wednesday, bringing the total for the past six days to $4.7 billion. Analysts believe that Bitcoin ETFs are currently the main driving force behind the demand for Bitcoin, absorbing most of the selling pressure from Long-Term Holders. The lack of significant growth in CME open interest suggests that this current rally is primarily spot-driven.

In other news, the Republican party has secured a majority in the House of Representatives, marking a trifecta after Donald Trump’s presidential win and the GOP’s success in flipping several Senate seats. The House of Representatives has been instrumental in passing crypto-related legislation at the federal level, particularly in the past year as multiple bills focused on cryptocurrency were approved. The Fairshake super PAC and its affiliated PACs, Protect Progress and Defend American Jobs, provided financial support to nearly 60 House and Senate candidates in the election, with the majority of them winning their races.

A recent survey conducted by digital asset bank Sygnum revealed that institutions are increasingly willing to make larger investments in digital assets, with 57% planning to increase their exposure to cryptocurrencies. This growing confidence in the asset class is fueled by a willingness to take risks and a long-term bullish outlook. The survey, which gathered insights from over 400 institutional and professional investors across 27 countries, found that 65% of respondents are optimistic about the long-term prospects of digital assets, with 63% considering increasing their allocation to digital assets in the next three to six months.

The Google Trends chart for the search term “bitcoin” in the U.S. over the past five years shows a spike in search interest, surpassing levels seen in June 2022 following the Terra/Luna collapse. The sustained interest from retail investors could potentially lead to higher trading volumes and prices, possibly triggering a speculative frenzy in the market.

It is important to note that CoinDesk, the source of this information, is a reputable media outlet that covers the cryptocurrency industry. The journalists at CoinDesk adhere to strict editorial policies aimed at ensuring integrity, editorial independence, and freedom from bias in their publications. CoinDesk is part of the Bullish group, which invests in digital asset businesses and digital assets. Some CoinDesk employees, including journalists, may receive equity-based compensation from the Bullish group.