The Ethereum “blockchain” is due for a major update on Wednesday, April 12. Called “Shanghai”, it is the culmination of a transformation that began several years ago, nicknamed “The Merge”, which has profoundly changed its operation by theoretically allowing it to make it less energy-intensive. . This new tipping point, the date of which was confirmed on Thursday after months of waiting, is awaited with apprehension by some investors.

Created in 2014 by Vitalik Buterin, it is a chain of blocks, that is to say a huge, tamper-proof computer ledger that serves as the basis for billions of dollars in operations. Ether, the cryptocurrency backed by Ethereum, represents only about 20% of the total value of existing virtual currencies, half that of bitcoin (40%), the most widely used cryptocurrency in the world.

However, Ethereum is a pillar of the cryptocurrency universe because it has a much wider scope of applications than its competitor. It serves as a support for multiple uses, such as the production of NFTs (non-fungible tokens, digital certificates), games and applications.

Performed in September 2022, “the Merger” consisted of changing the mode of validation of operations on the Ethereum blockchain, switching it from a protocol based on “proof-of-work”, to a another protocol based on a “proof-of-stake”.

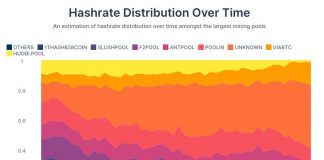

With “proof of work”, the production of blocks in which transactions are logged is performed by “miners” – computers whose resources are devoted to securing the network. To produce a block and continue the continuity of the chain, it is necessary to carry out calculations, the first miner who succeeds in the operation being rewarded in cryptocurrencies. The more network participants there are, the more complex the calculations, and therefore more energy-intensive.

With “proof of stake”, we no longer speak of “mining”: rather, we must prove that we own the cryptocurrency in question and immobilize a certain amount to participate in the validation of transactions. People who place part of their capital in escrow in this way can then become “validators” and obtain income in exchange, much like depositing money in the bank. What makes it possible to reach a consensus between blockchain users is therefore no longer the computing power they use but rather the sums they invest in it, hence the notion of stake.

It aims to allow users who have tied up ether (known as “staker” or “staking” in cryptocurrency jargon) to withdraw them again. As part of the “Merger” and the transition to “proof of stake”, funds had indeed been blocked since 2020. They are estimated at 16% of the total number of ether, according to Bloomberg, or 18 million tokens for a value of 32 billion euros, at the current price. Nearly 1.2 million ether, worth €2.1 billion, could be withdrawn and converted within five days of the update, according to analytics site CoineMetrics.

Apart from the potential technical problems (which were not exempt in particular from the tests carried out before the “Merger”), the whole issue is how many investors will want to recover their funds. While Ether’s price has been on a rollercoaster ride in recent years, it’s still about tripled since the end of 2020, so validators who have had their tokens tied up since that time might be tempted to convert them. Withdrawals which, even if they will be voluntarily limited in order to preserve a minimum of the stability of the cryptonaie, could have an impact on its course.

Added to this are the potential hacks and misappropriations, the transition periods being conducive to this, as well as the desire displayed in recent months by the SEC (Securities and Exchange Commission, the policeman of the American markets), to exercise tight control on the practice of staking.