The US spot Bitcoin exchange-traded fund (ETF) market experienced another day of net outflows on June 13, with Fidelity Investments’ FBTC leading the way in outflows. BlackRock’s IBIT was the only fund to see net inflows on that day, with $18 million coming in. Overall, data from SoSoValue shows that spot ETFs had net outflows totaling $226.21 million.

Fidelity’s FBTC saw outflows of $106 million, making it the second-largest outflow for the ETF since it started trading. This accounted for nearly half of the total net outflows. Grayscale’s GBTC ETF had net outflows of $62 million, while Ark Invest’s ARKB and Bitwise’s BITB saw $53 million and $9.8 million leave their funds, respectively. VanEck’s HODL fund also experienced net outflows of $11.3 million, and approximately $2.7 million exited Invesco and Galaxy Digital’s BTCO.

The outflows on June 13 followed a day where the US spot Bitcoin ETFs market had snapped a two-day streak of outflows with $100.8 million in inflows. The total net inflows to all US spot Bitcoin ETFs had reached $15.5 billion before the $206 net outflows on June 13 brought it back to about $15.3 billion.

SEC chair Gary Gensler announced to lawmakers that he anticipates the agency approving S-1 filings for spot Ethereum ETFs “in the summer.” Both Bitcoin and Ethereum prices remained below key levels amidst this news and the outflows from spot BTC ETFs.

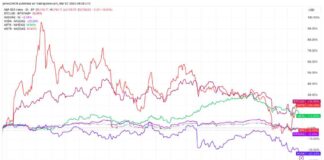

Bitcoin’s price dropped from highs near $70,000 to around $66,450, currently sitting at approximately $66,900 at the time of writing, marking a 5.9% decrease for the week. Ethereum’s price was around $3,500, down almost 8% for the week.

Despite the struggles in the Bitcoin ETF market and the price fluctuations of both Bitcoin and Ethereum, investors continue to closely monitor the developments in the cryptocurrency space. The approval of spot Ethereum ETFs could potentially bring new opportunities and increased interest from investors looking to diversify their portfolios with digital assets. It will be important to keep an eye on how these market dynamics continue to evolve in the coming weeks.