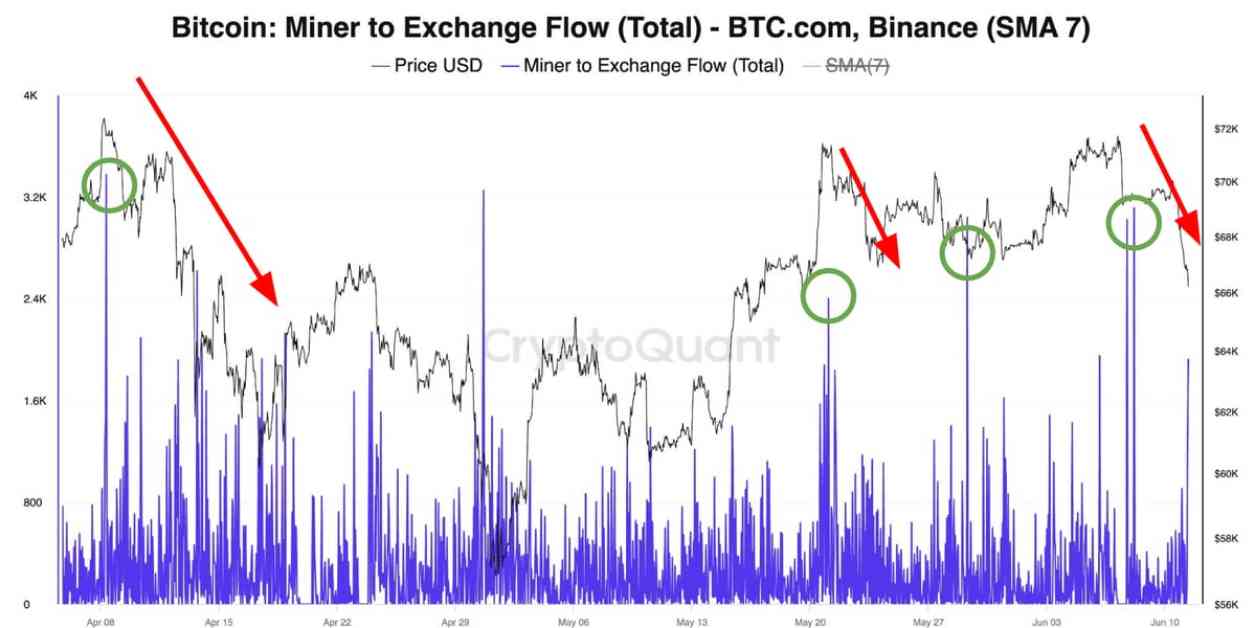

Bitcoin miners have been taking advantage of the recent rally in BTC prices, with a significant amount of BTC transfers from mining pools to exchanges totaling $209 million. This surge in transfers coincided with a drop in BTC price from $70,000 to $66,000 before bouncing back. Marathon Digital, a prominent mining company, has sold 1,400 bitcoins worth $98 million since the beginning of June.

Additionally, over-the-counter (OTC) trading volume has also seen a spike to a two-month high, indicating increased selling activity among miners. This trend is likely driven by the recent bitcoin halving, which led to a decline in daily mining revenue. On June 10 alone, miners sold at least 1,200 BTC, marking the highest daily total in two months.

The decrease in daily miner revenue, which currently stands at $35 million, down 55% from its peak in March at $78 million, can be attributed to lower transaction fees post the halving. This reduction in revenue has prompted miners to capitalize on selling their holdings to exchanges and OTC desks.

In the U.S., Marathon Digital has been actively selling off its BTC holdings, further contributing to the increased selling activity among miners. The cryptocurrency industry is closely monitoring these developments as they signal a shift in miner behavior following the recent market dynamics.

It is clear that miners are adapting to the changing landscape post the bitcoin halving event, where the block reward was cut in half, impacting their daily revenue. The spike in transfers from mining pools to exchanges and the surge in OTC trading volume indicate that miners are taking proactive steps to manage their holdings and optimize their profits in the current market conditions.

Overall, these recent developments highlight the dynamic nature of the cryptocurrency market and the strategic decisions that miners are making to navigate these changes effectively. As BTC continues to experience price fluctuations and market volatility, it will be interesting to see how miners adjust their strategies to remain profitable in the ever-evolving crypto ecosystem.