Coolpad Group, a Chinese telecommunications company based in Shenzhen and listed on the Hong Kong Stock Exchange, is making a significant investment in the world of cryptocurrency. The company has announced its plans to spend $13.5 million on acquiring 2,700 Bitcoin mining rigs, which will be deployed in North America.

This move marks Coolpad’s entry into the crypto space, with a specific focus on Bitcoin mining. The company has set aside over HK$106 million for this initiative, signaling its commitment to exploring opportunities in the rapidly evolving digital asset industry.

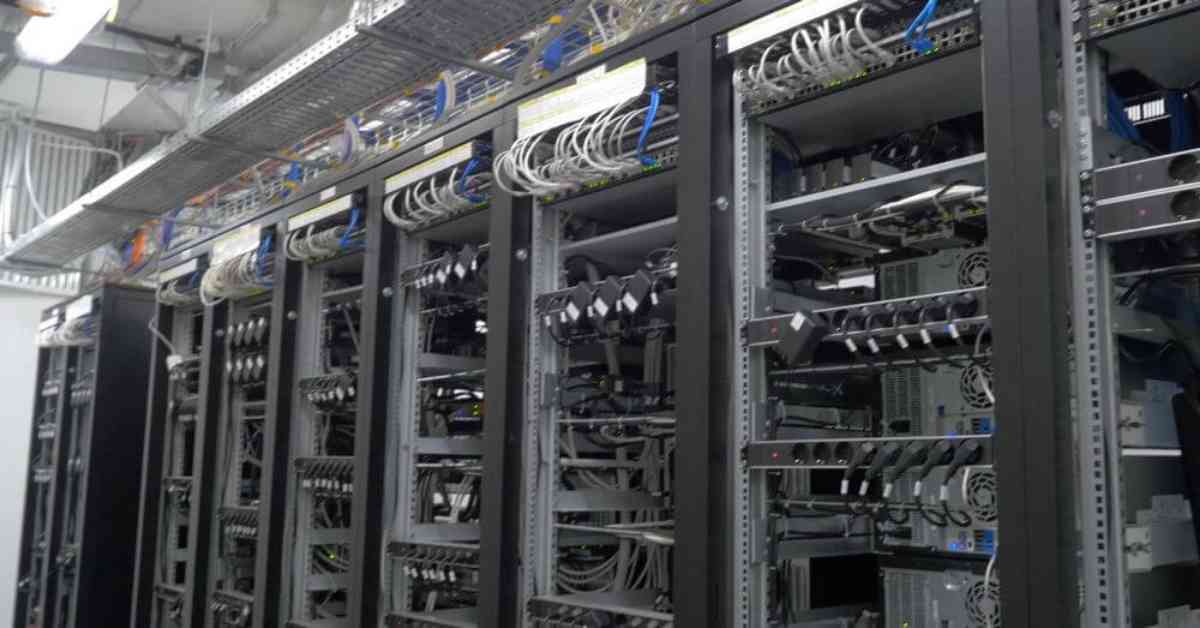

The decision to acquire the mining rigs from JingYun Intelligent Technology, a Hong Kong-based firm, demonstrates Coolpad’s strategic approach to expanding its computing power. The investment is expected to boost the company’s computing power from 873,000 TH/s to approximately 1,504,800 TH/s, positioning Coolpad as a key player in the competitive world of cryptocurrency mining.

In addition to investing in Bitcoin mining rigs, Coolpad is also exploring opportunities in the broader crypto and Web3 space through a multi-million share purchase plan. The company is targeting shares of crypto-related firms in the US, including CleanSpark, a prominent BTC miner.

This development comes at a time when the crypto industry is gaining increased attention from global leaders and policymakers. Former US president Donald Trump recently met with top Bitcoin mining companies operating in the US, expressing his support for the industry and advocating for more mining operations to be based in the US.

Coolpad’s strategic investment in Bitcoin mining rigs and its broader foray into the crypto space reflect the company’s forward-looking approach to technology and innovation. By leveraging the power of cryptocurrency and blockchain technology, Coolpad aims to position itself as a key player in the digital economy of the future.

As the company continues to explore opportunities in the crypto space, investors and industry observers will be closely watching Coolpad’s progress and the impact of its investments on the evolving landscape of digital assets and decentralized technologies.