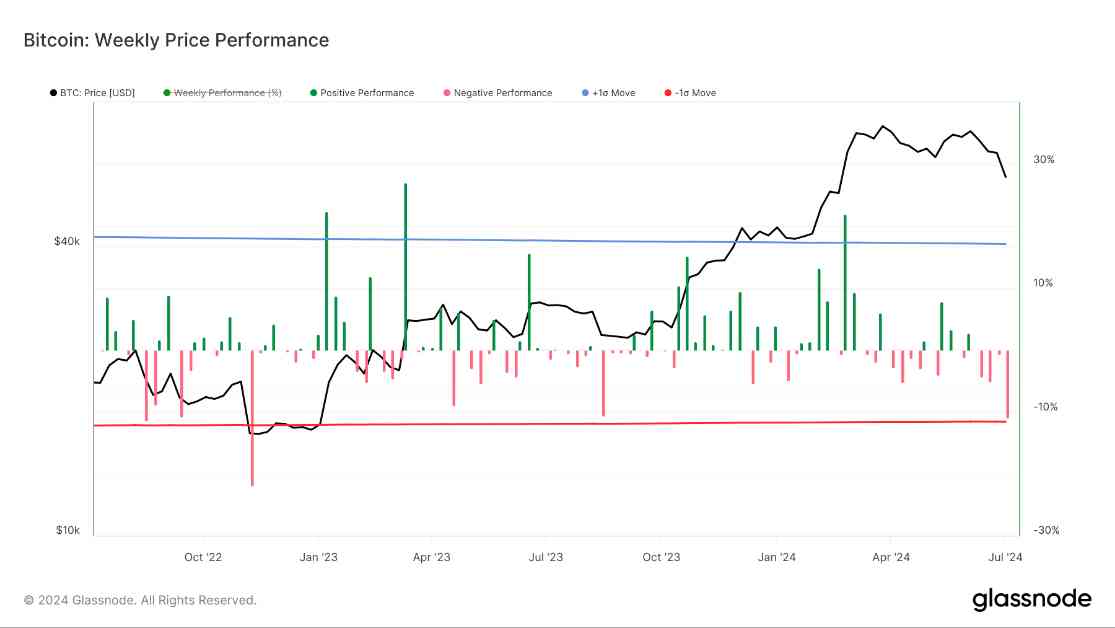

Bitcoin has been on a rollercoaster ride in recent weeks, experiencing four consecutive weekly declines that have sparked memories of the 2017 bull market. This recent decline, which saw an 11% correction in the first week of July, is reminiscent of the FTX collapse in November 2022 when Bitcoin plummeted by approximately 22%.

The current pattern of corrections and potential consolidation throughout the summer is similar to what was seen in August 2023, when Bitcoin fell below the 200-day moving average and consolidated for several months before beginning a recovery in October. This could indicate that Bitcoin may stabilize and consolidate throughout the summer before potentially seeing an upward movement in the fourth quarter.

During the 2017 bull run, Bitcoin experienced multiple daily corrections of 5%, a trend that seems to be repeating itself now. Recent drops of nearly 5% on June 24, over 5% on July 4, and 4% on July 7 mirror this pattern. Currently, Bitcoin is 23% below its all-time high, with the most significant drawdown reaching 27% when it dipped just below $54,000.

The market could potentially see stabilization and consolidation before any significant upward movement, as Bitcoin continues to experience frequent corrections. This pattern suggests that investors may need to exercise caution and patience as the cryptocurrency market navigates through this period of uncertainty.